The modern household collateral loan pricing within the Alabama for ten-year fund average 8.2%, compared to the federal price from 7.7%. Getting 15-12 months finance, an average is actually 8.4%, because the federal speed really stands during the seven.9%.

From the Zachary Romeo, CBCA Reviewed by the Ramsey Coulter Edited of the Lukas Velunta By Zachary Romeo, CBCA Reviewed from the Ramsey Coulter Edited because of the Lukas Velunta With this Page:

- Newest AL HEL Cost

- AL HEL Costs of the LTV Ratio

- AL HEL Prices by City

- AL HEL Lenders

- How to get a knowledgeable HEL Rate

- FAQ

The guarantee of your home that you could supply and borrow is called tappable equity. A property collateral financing (HEL) can help you maximize your home guarantee, whether you’re trying money home improvement strategies otherwise combine loans.

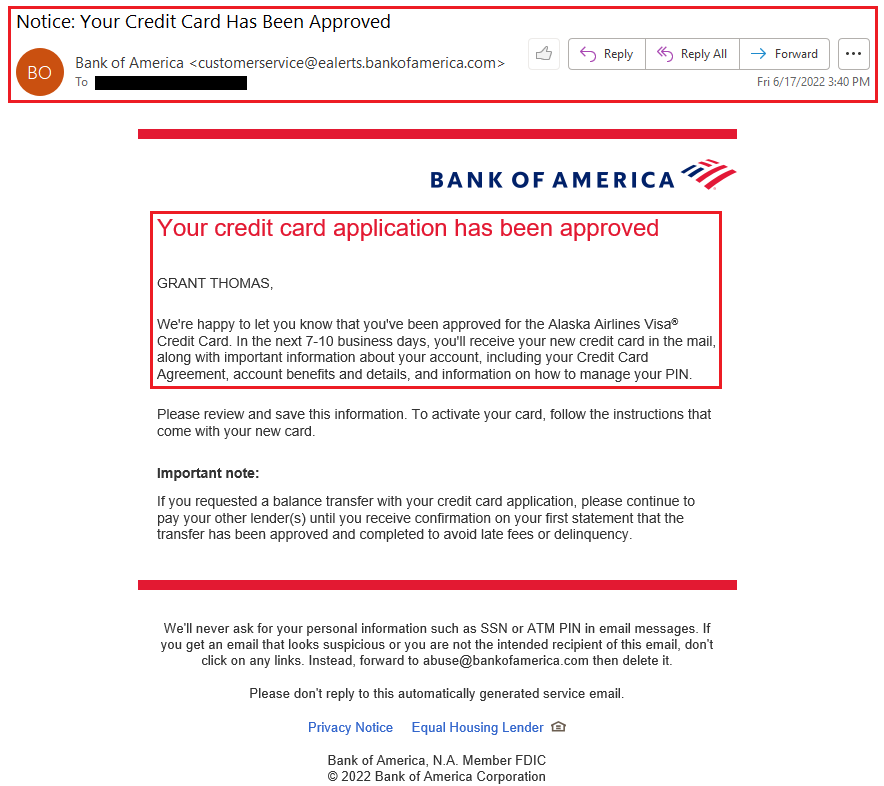

Alabama’s home security financing prices is significantly more than federal averages – 8.2% Apr to own an excellent ten-season identity (7.7% nationally) and 8.4% Apr for a good 15-seasons term (7.9% nationally). We’ve got built-up outlined insights on the most recent home guarantee mortgage prices when you look at the Alabama, in addition to area-particular prices, most readily useful loan providers, and you can great tips on protecting the best prices for using their residence’s security.

Key Takeaways

High LTV ratios trigger higher pricing. The typical an among an 80% LTV was 8.3%, compared to the 8.6% for good ninety% LTV.

HEL costs are different of the city in Alabama. Including, getting 15-season fund, Millport provides the typical Annual percentage rate out of 6.0%, whereas Midfield’s was 10.7%. Continue lendo Household Collateral Loan Prices when you look at the Alabama ()