Financial and Added bonus disclosure

That is A publicity. You aren’t Needed to Make any Commission And take People Almost every other Step As a result To this Render.

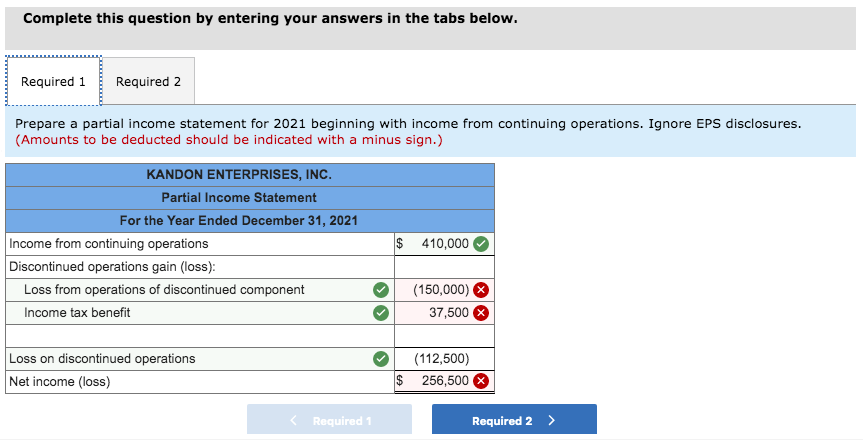

Earnest: $step one,000 to own $100K or maybe more, $200 to have $50K to help you $. To have Earnest, for individuals who refinance $100,000 or maybe more by this webpages, $five hundred of your own $step 1,000 bucks extra is offered really because of the Student loan Planner. Price assortment above includes elective 0.25% Auto Spend discount.

Terms and conditions use. To be eligible for this Earnest Added bonus bring: 1) you ought not already be a serious customer, or have received the advantage in earlier times, 2) you ought to fill in a done student loan refinancing software through the designated Student loan Coordinator link; 3) you must offer a valid email and you may a valid examining membership amount when you look at the application procedure; and you may cuatro) your loan need to be completely disbursed. Continue lendo On $1,000 Greeting Bonus offer, $five-hundred could be repaid really because of the Education loan Coordinator via Giftly