Do you Spend the money for Monthly payments?

You will have to shell out your house security financing at the top of almost every other monthly premiums you make, together with your homeloan payment. Ensure that your finances can handle a unique fee, especially if you intend to use an enormous sum.

Do you know the Money Getting?

Credit against their residence’s security should be high-risk, so you should guarantee that it really is practical so you can do so.

Household equity finance are popular to possess debt consolidation reduction or do-it-yourself ideas, as you can be borrow large quantities of money at the a reduced rates than you might otherwise manage to. Speaking of in addition to points that helps you change your economic state full, either from the letting you reduce high-focus personal debt or creating improvements that add really worth to your house.

Greatest Home Collateral Loan lenders Faq’s

What’s the current average rates to possess property security mortgage? Chevron symbol This means an expandable point or menu, or both prior / next routing alternatives.

Family security mortgage prices fluctuate everyday, but you can check out Business Insider’s self-help guide to current house equity mortgage pricing to see exactly how these are typically trending today.

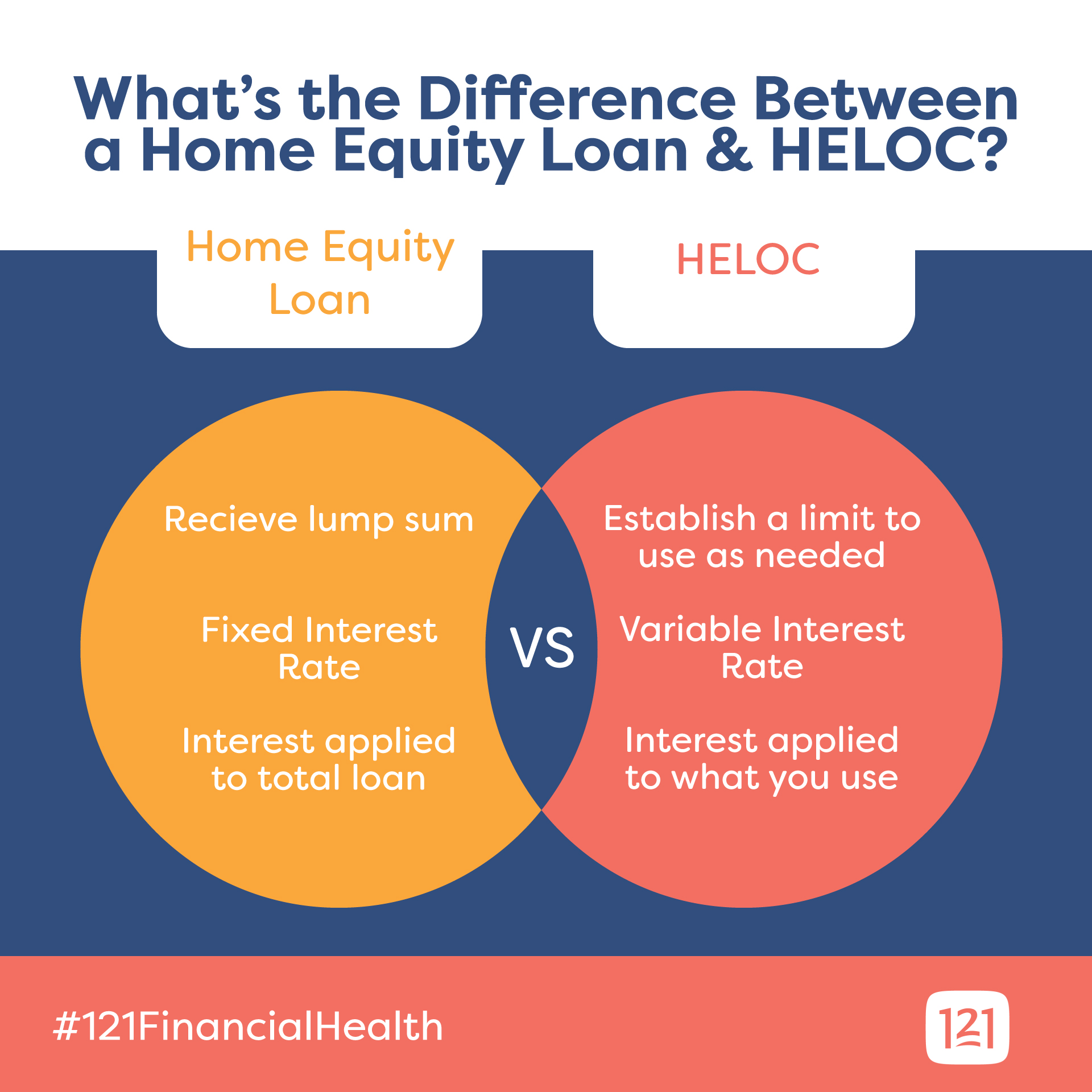

What is the difference between an effective HELOC and you may a home security mortgage? Chevron symbol This means a keen expandable point otherwise menu, otherwise either previous / 2nd routing choices.

HELOCs will let you borrow against a credit line and you can feature an adjustable rate, if you are house security money try fees loans which might be repaid in equivalent amounts throughout the years at a fixed rates. Continue lendo Why you need to Faith United states: How Did We Choose the best Home Guarantee Loan lenders?