- Inclusion

- Prior to i begin

- Simple tips to code

- Study clean up

- Investigation visualization

- Feature technologies

- Design studies

- End

Introduction

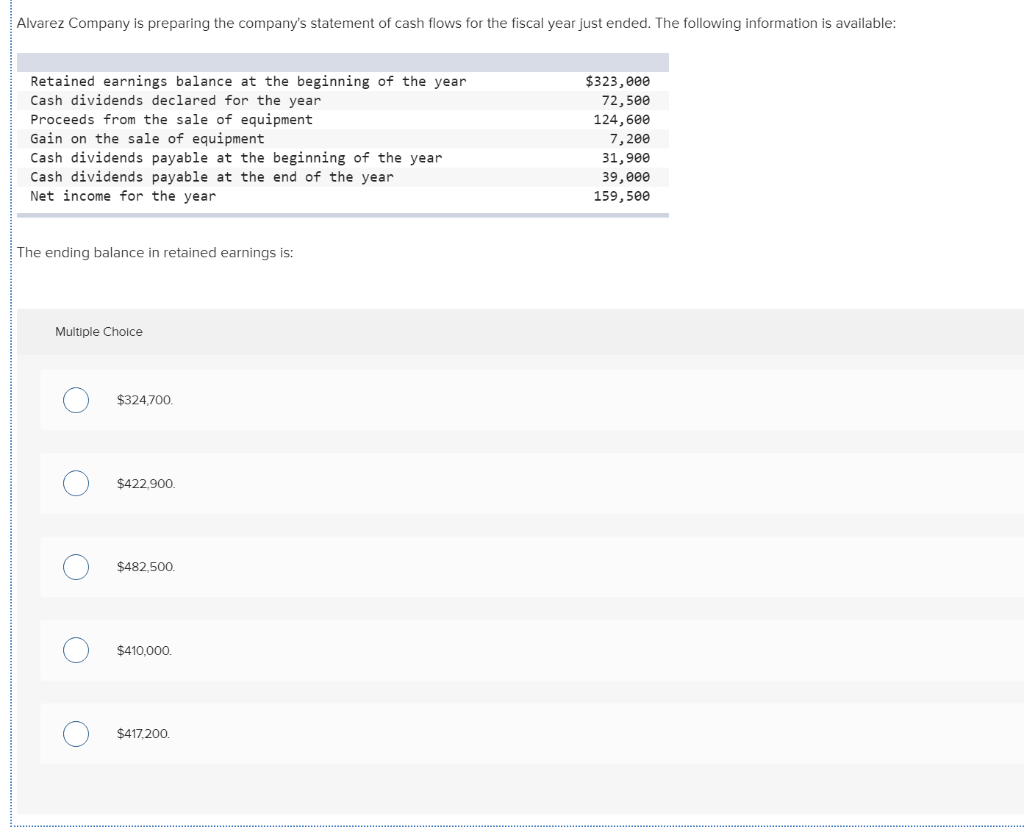

The fresh Dream Homes Loans business purchases in every home loans. He has an exposure around the all of the urban, semi-metropolitan and outlying payday loan Pine Hill section. Customer’s right here earliest submit an application for a mortgage and also the providers validates the newest owner’s eligibility for a loan. The company desires speed up the loan qualification procedure (real-time) predicated on buyers info considering if you are filling out on line application forms. These details try Gender, ount, Credit_History although some. So you can automate the method, he’s offered problems to identify the consumer locations one to qualify with the amount borrowed and additionally they can especially address these types of users.

Before we begin

- Numerical keeps: Applicant_Money, Coapplicant_Earnings, Loan_Number, Loan_Amount_Identity and Dependents.

Just how to password

The firm have a tendency to approve the loan into the candidates having a a great Credit_History and you will who’s likely to be able to pay back the fresh new fund. For that, we are going to load the fresh new dataset Mortgage.csv within the a great dataframe showing the original five rows and look their shape to ensure i’ve sufficient analysis and also make the model design-in a position.

You will find 614 rows and you will 13 articles that’s sufficient data while making a production-ready model. Continue lendo A meaning state where i predict whether that loan can be acknowledged or otherwise not