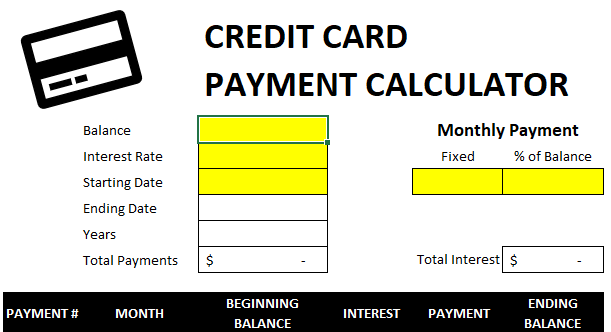

The new Fees Calculator are often used to select the fees count or amount of costs, such as for instance playing cards, mortgages, auto loans, and private money.

Result

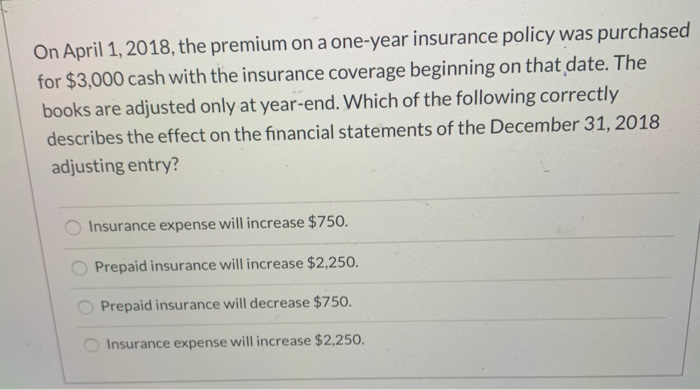

Fees is the operate regarding paying back currency in earlier times lent off a lender, and you can failure to repay obligations could easily push one to declare themselves bankrupt and/otherwise seriously affect credit rating. New costs off individual money are made in occasional money that are included with some prominent and appeal. Regarding the calculator, there are 2 fees times to pick from: a predetermined mortgage name otherwise a predetermined fees.

Fixed Loan Term

Prefer this option to go into a fixed loan name. For instance, the new calculator can be used to see whether an excellent 15-season otherwise 31-season home loan can make a lot more feel, a common choice many people need to make when purchasing a great domestic. New calculated overall performance often monitor the fresh new month-to-month repayment needed to shell out off the mortgage for the given mortgage title.

Repaired Installment payments

Choose this option to get in a predetermined amount to be distributed monthly through to the financing and you will appeal try paid in full. The brand new calculated efficiency tend to screen the loan label needed to spend off of the loan at this monthly fees. As https://cashadvancecompass.com/payday-loans-wi/ an instance, which ount away from throw away income determined by subtracting expenses away from earnings which can be used to expend back credit cards equilibrium.

Regarding the U.S., all the consumer loans are prepared becoming repaid monthly. The following are four quite prominent finance. Continue lendo It can be used for ongoing expenses and you may the newest financing