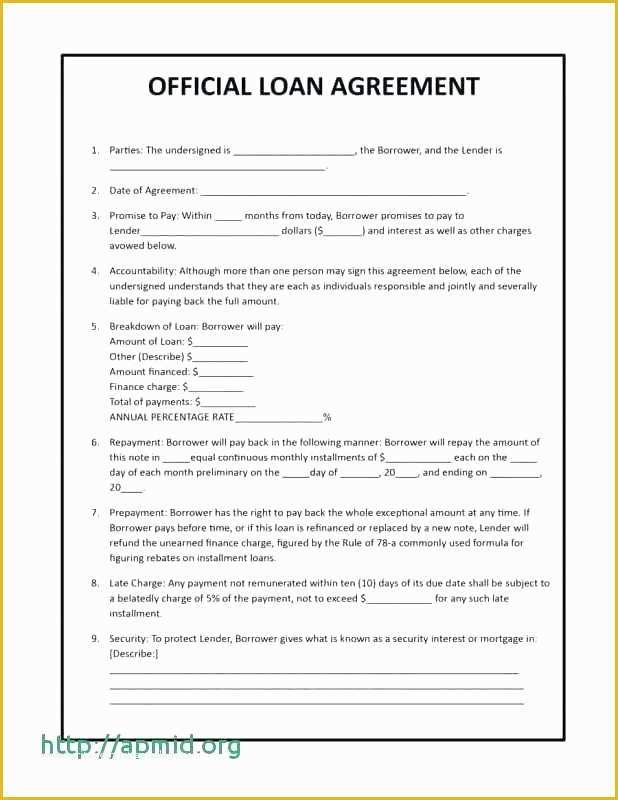

The new lack of chance loads and standard advantage provisioning to your certain types of construction financing tend to all the way down housing loan rates and increase houses financing profile regarding banks

The latest Reserve Lender away from Asia don’t reduce the trick coverage price repo rates on the Wednesday but has made policy changes that guarantee brand new home fund might be less.

This new expectation from lesser mortgage is really because the brand new RBI possess less the quality assets provisions into the individual property loans to 0.25 percent and have now reduced the chance loads into the such as for example financing.

Inviting the option of RBI, ICICI Financial MD and President Chanda Kochhar said the latest Slr camera clipped and you will loss in exposure weights having houses finance are confident motions that will service financial exchangeability and you can remind development in houses funds

Since a good countercyclical measure, the fresh LTV (mortgage to help you worthy of) percentages, exposure weights and you will fundamental advantage provisioning rate to own private homes financing had been analyzed off today, the RBI told you on next bi-month-to-month coverage report.

The product quality resource conditions, or even the amount of money to get set aside for each loan made, has https://paydayloansconnecticut.com/oakville/ been paid off so you’re able to 0.25 percent on prior to 0.forty %, which can only help slow down the rates with the home loans.

In addition it eased the danger loads without a doubt categories of funds, which will surely help financial institutions into the resource adequacy front, and invite these to build a whole lot more fund.

The chance lbs to possess personal property financing above Rs 75 lakh might have been smaller to 50 % on before 75 percent, if you’re to have financing ranging from Rs 31 and you may Rs 75 lakh, a single LTV ratio slab all the way to 80 percent have been introduced that have a threat pounds out of thirty five percent. Continue lendo RBI might not have clipped coverage price but new home finance set-to get cheaper; the following is why