What is actually Closure?

Closure ‘s the final stage regarding a purchase ranging from one or two functions. An ending normally refers to the finally phase out of a great homebuying procedure in which the visitors gets the deeds and merchant receives the commission. Both parties signal the last data so you can officialize the https://paydayloansconnecticut.com/south-woodstock/ order.

Secret Takeaways

- Closure is the last stage away from a purchase, typically for mortgage control.

- In closing home financing, the house or property label entry about vendor on the buyer.

- When you look at the closing processes is additionally entitled payment otherwise membership settlement.

- In the closure, your review, approve, and day several judge documents doing the home pick.

- Requisite closure documents include the closing disclosure, promissory notice, and you will action from trust.

Just how Closure Functions

Closure is the final step in this new homebuying techniques in which the loan gets specialized while the term was moved to the brand new citizens. An ending representative, always an attorney or formal away from a subject or mortgage company, manages the new closing process, which takes put during the a name providers otherwise escrow workplace.

The borrowed funds closing processes differs from one state to another. This course of action is known as a closing since the escrow account utilized to complete the property get techniques gets signed. Through the closing, referred to as payment otherwise account payment, the participants remark, approve, and you will day numerous courtroom files.

Expected Closure Records

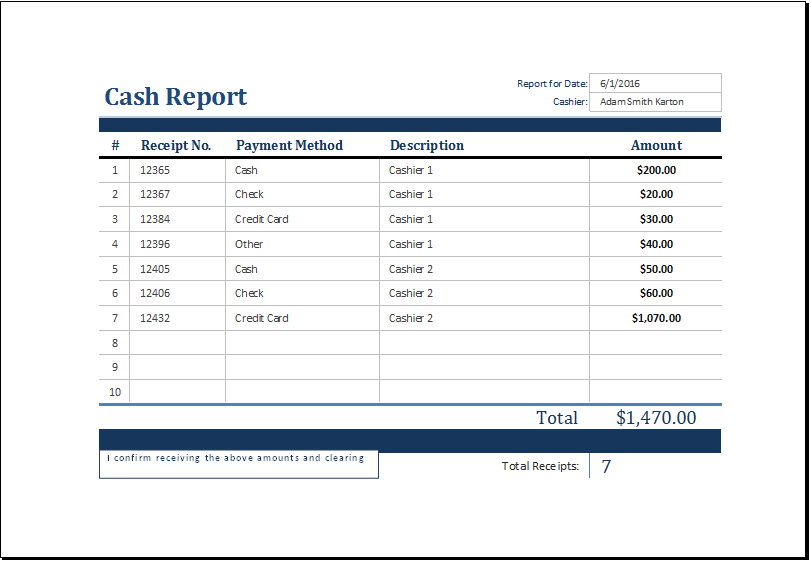

- Necessary for federal law, the brand new closure disclosure or report directories all the will set you back linked to the latest assets buy, together with financing charge, a property taxes, and other expenditures. Continue lendo Closing: What it is, How it works, Conditions