Financial loan providers charge certain charge to purchase will set you back they happen when you look at the control the mortgage and you may keeping the characteristics they give you. Such even more charge are also designed to often remind or dissuade specific behaviors (i.age. lenders will typically cost you when you’re late on the payments or if you repay your loan early).

It’s not unusual to own huge finance companies in order to charges upfront charge that security application, settlement, and you can valuation, also lingering and you will leave charge. Smaller banking institutions may costs those people, many may offer lower fees otherwise waive these to attract users. They may also offer far more beneficial terms and conditions regarding launch costs compared towards the five majors.

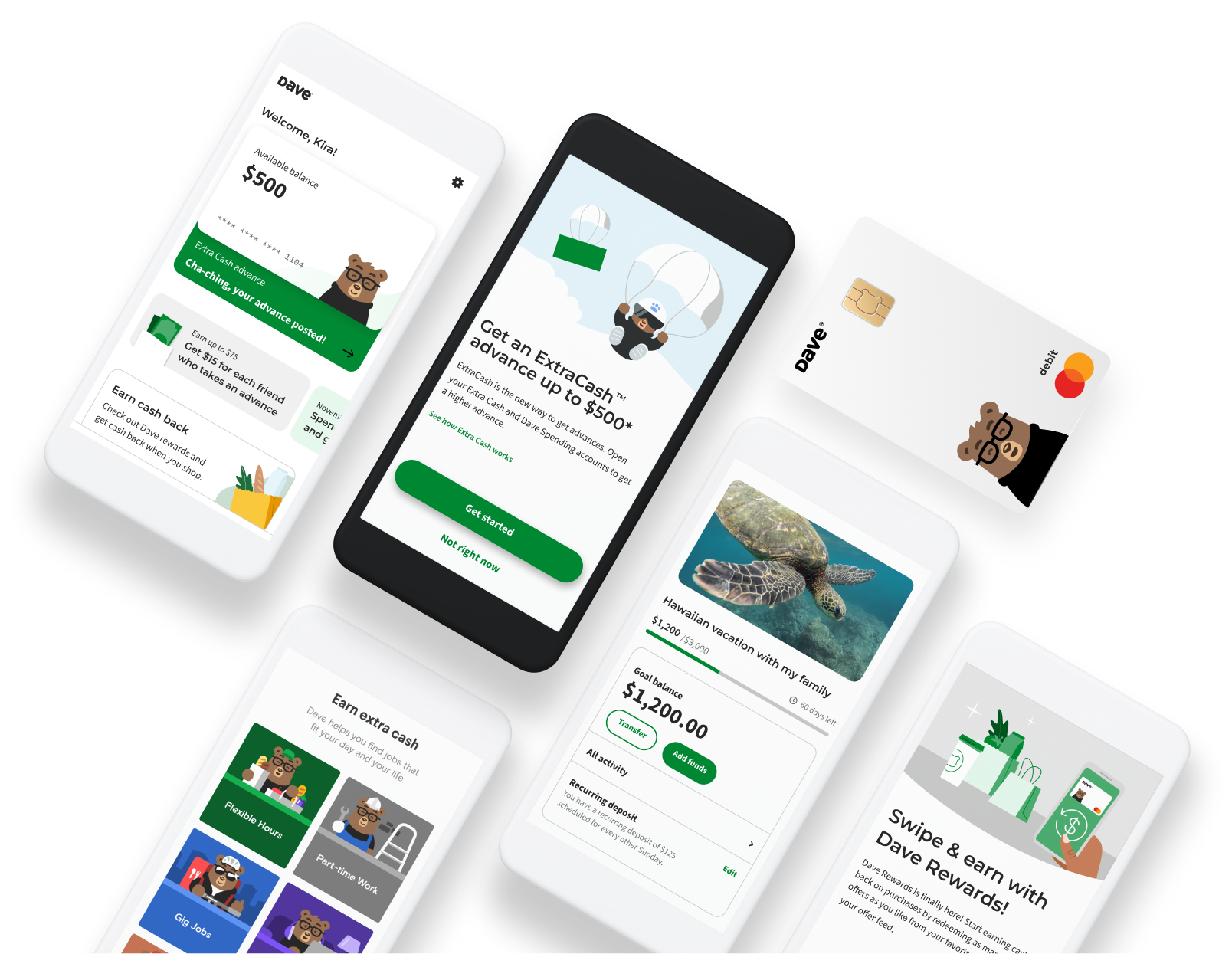

Technology and advancement

If you love efficiency, convenience, and you may self-reliance, a financial that have a robust work with fintech and development are well-known possibilities. Furthermore, possess eg real-date loan updates status, online cost arranging, and simple loan variations always keeps deeper power over your home loan.

Currently, most banks features significant opportunities during the digital banking networks. Although not, while the big players provide total online and mobile financial qualities, faster and you can non-lender loan providers is generally quicker into entice using reducing-border tech to automate procedure and gives aggressive financing affairs. Continue lendo Cutting-edge electronic networks normally improve application for the loan and you may recognition