Whenever considering buying your basic home, it is vital to can holds with exactly how mortgage dumps works, in addition to how much you will have to conserve and statutes up to talented dumps.

Mortgages are available at around 95% loan-to-worth (LTV) , meaning it’s possible to log in to the house or property ladder that have good put of 5% of one’s price and you will a mortgage covering the leftover 95%.

Just how much how about to store?

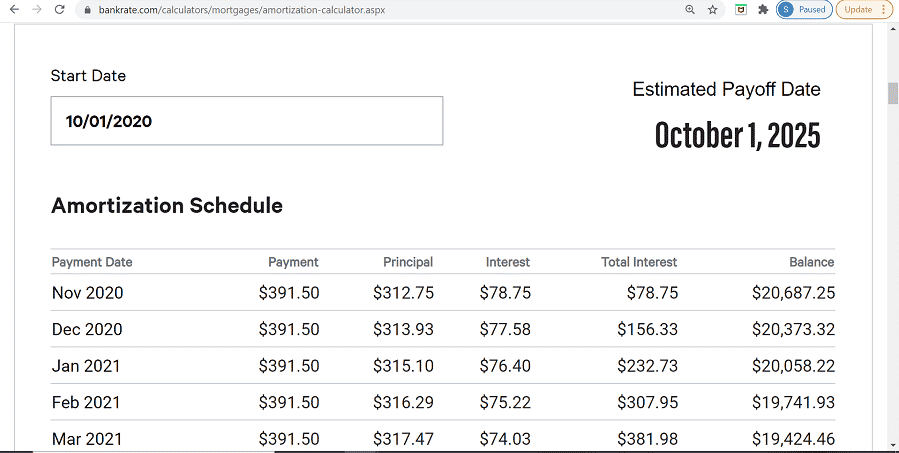

So you’re able to assess exactly how much you will need to save for your mortgage put, there’s two things you must look into: regular possessions rates and month-to-month fees will cost you.

Property pricing near you

You can buy a crude notion of local family rates out of possessions portals such as for instance Rightmove and you may Zoopla, by speaking to regional auctions.

The fresh new data you’ll see on websites and you can representative websites are asking costs, so that they was a little more than exactly what the qualities are incredibly worthy of.

For lots more tangible pointers, you can check exactly how much house in your neighborhood provides ended up selling for using the brand new Land Registry’s price paid equipment

Just how much you can afford inside the costs

With each monthly mortgage repayment, you’re going to have to pay desire also a few of the financing in itself. Continue lendo Just how much deposit how would you like getting a mortgage?