But mortgage lenders do not think in that way. Which can be because earnings is just one small-part of your mortgage picture.

Whenever all things are felt, such as your debt, advance payment, and you may home loan speed, you could find you could potentially acquire doing six or seven times the salary to have a home loan. Or your allowance could be smaller.

- twenty-three things that regulate how much financial you really can afford

- ‘How far home loan ought i manage back at my salary’ calculator

- Debt, income, and your real estate funds

- Home loan costs plus property finances

- The down-payment as well as your home buying budget

- Your home loan app need not be primary

twenty-three things that decide how far home loan you really can afford

The total amount you could borrow to have a mortgage hinges on how much a lender thinks you can pay off. And this equation isn’t only centered on your paycheck; there is an entire host off facts loan providers thought.

- Creditworthiness – Do your credit score and you can report strongly recommend you are an accountable borrower that will focus on mortgage payments?

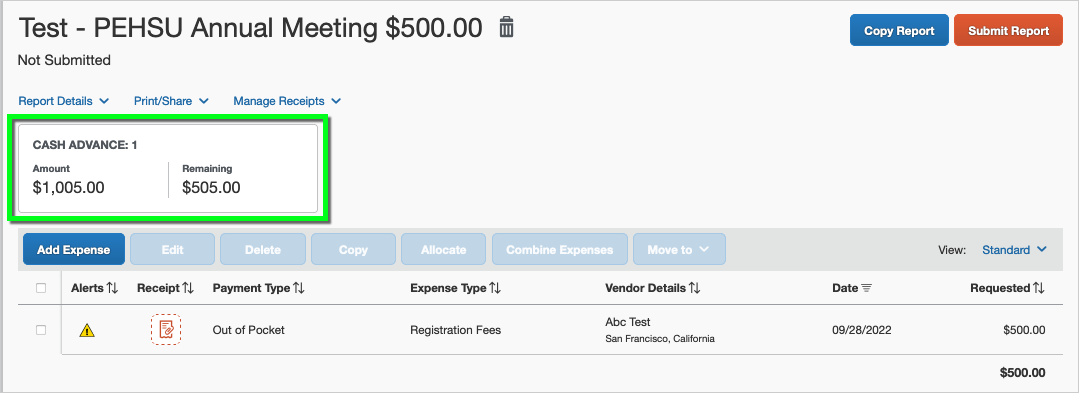

- Down-payment – The greater amount of currency you spend, the fresh new quicker the lender really stands to reduce if the mortgage defaults

- Debt-to-money (DTI) ratio – Whenever making an application for a mortgage, your income is often seen in the context of the debt load

Every one of these things is roughly as important as the rest. Continue lendo How often my personal paycheck ought i borrow for a mortgage?