Due to the fact Paycheck Cover Program (PPP) was initially launched, millions of small businesses enjoys rushed to apply in hopes out-of choosing regulators financial support to help you endure its businesses from constant pandemic . Not surprisingly serious prominence, you will find nonetheless loads of suspicion to PPP financing. Regarding app and resource strategy to installment and loan-conversion, small enterprises are struggling to higher understand the information on the brand new Paycheck Safety Program.

A typical question one to send-thought small enterprises inquire about PPP finance applies to taxes: Are my personal PPP loan income tax-allowable?

The latest short answer is sure, he is! The economic Support Act made clear that all company costs paid back with PPP finance are in fact tax deductible. Our company is looking forward to next Internal revenue service tips on this to fully see how the procedure work.

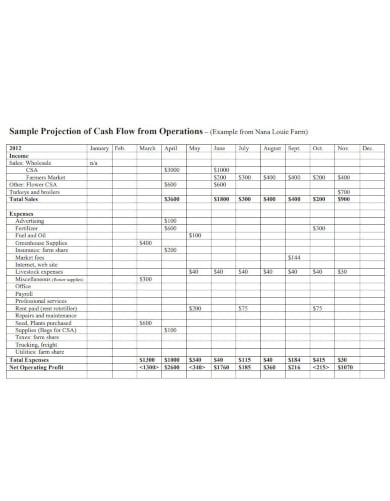

At the same time, make an effort to very carefully tune all your expenses with the intention that you are willing to claim these types of deductions if date arrives. You really need to already be categorizing their PPP mortgage expenditures on dos kinds to help you discovered forgiveness. New SBA identifies him or her given that payroll costs and almost every other providers expenditures.

Payroll Costs

These kinds have a reputation that quickly conjures images from paychecks, but it’s more than simply you to definitely. Accepted expenses when you look at the payroll group become:

- Compensation in the form of wages, wages, commissions, or comparable compensation doing $one hundred,one hundred thousand

- Commission of cash tips or equivalent

- Payment having trips, adult, friends, scientific, otherwise ill log off

- Allowance having dismissal or separation

- Percentage regarding pensions

- Group sight, dental care, disability, or life insurance

- Fee regarding state or regional fees reviewed towards the payment of team

According to the forgiveness legislation laid out by the SBA, you must play with no less than 60% of one’s PPP mortgage cash on payroll can cost you. If the discover reductions into the staff member salaries, the quantity it’s possible to have forgiven ple, a decrease in 25% or maybe more inside annual income for employees who generate less than $100,one hundred thousand a-year can lead to a smaller forgiveness amount.

Most other Providers Costs

As title of payroll costs category can make it voice significantly more narrow than it is, the opposite holds true for this second classification. What almost every other business costs voice on the as large as you can imagine, implying this category is some kind of hook-the. Nevertheless SBA has furnished a summary of certified expenses, although the guidelines were many beneficial purposes for the cash, these kinds certainly actually meant for everything you other than payroll.

- Healthcare costs linked to the fresh extension off class medical care benefits throughout periods out of unwell, scientific, otherwise household members get off, along with insurance costs.

- Home loan focus repayments (yet not prepayment or payment of your own mortgage dominant)

As you can tell, nearly all their organizations functioning costs are entitled to forgiveness. Just make sure which you song everything you and continue maintaining their facts upright to be able to complete ideal files when it’s required.

Is PPP Loans Nonexempt?

No matter if you could claim deductions to the expenses financed having mortgage fund try an entirely different ball game regarding the taxability of loans by themselves. Thus are a PPP mortgage nonexempt?

PPP loans will not be taxed at the a national height, but some claims have chosen to add the fund just like the nonexempt earnings. You can examine together with your condition observe in the event you will end up necessary to shell out county taxation into the mortgage.

Hiring the help of Bookkeeping Professionals

Because the an entrepreneur, you have a million anything on your dish. You might free up valued time by delegating your own bookkeeping to help you an accounting solution that will improve reliability and you https://cashadvanceamerica.net/400-dollar-payday-loan/ will save some costs. Such as for instance, Dawn offers an online accounting tool to help you stick to greatest of one’s expenditures so you’re able to be certain that you are sticking with the new SBA’s debts legislation to own PPP money.

Once you’ve connected their playing cards and you may business savings account, your expenses and you will income was immediately classified. That’s true-you don’t need to search through invoices and you will be concerned more than the specific areas of your day-to-day expenses.

Income tax 12 months definitely will lose the its sting when you have accounting service. You’ll end up so much more available to their annual filings, since your super-planned money make it easier to subtract qualified organization costs reduced along with your PPP mortgage. The brand new ancillary work for is the fact the careful recording will support your time and efforts to get the greatest percentage of the loan forgiven.