- Military energetic obligation fitness specialities loan repayment program: Nurses just who enlist to own productive duty for around three years will get 33.step three percent of its financing dominating equilibrium paid back of the Army.

- Army supplies health care masters financing cost system: Nurses whom suffice regarding the Military Supplies get around $20,000 for a few straight years of provider, along with an additional $10,one hundred thousand and you can a supplementary 3rd season.

- Military reserves college or university mortgage repayment program: Nurses exactly who enroll from the Army supplies having half dozen decades will get discover around $50,100000 to spend student loans.

- Navy nursing assistant applicant program (NCP): People who will be approved towards Nurse Candidate System (NCP) is also discover around $34,100000 to help shell out the means because of school.

- Sky force effective duty health specialities fees system (ADHPLRP): Nurses whom be involved in active obligations to possess at least a few years can be located a maximum repayment as high as $40,000.

County Financing Forgiveness Applications for Nurses

Each one of these apps (regardless if not all the) require nurses to get results inside a doctor Lack Town (HPSA) that is already understaffed by medical professionals. Always nurses agree to at least several-12 months commitment, towards the substitute for work for a longer period of time in return for greater mortgage forgiveness.

Understand the table less than you http://www.availableloan.net/personal-loans-oh/hudson to lists financing fees apps and the restriction annual matter for everyone fifty claims. We including emphasize a few applications in the more detail to provide your a concept of the way they functions.

Alaska: The newest Clear-I System gets nurses as much as $20,one hundred thousand a year in return for performing no less than one or two decades when you look at the an HPSA. The newest Clear-II program pursue an equivalent set-up, but needs a three year connection and a 25% fits from your own employer. The greater critical the lack in your community, the greater number of the loan forgiveness.

Illinois: Illinois actually now offers about three other repayment agreements getting nurses: The latest Nurse Educator Mortgage Cost Program, the new Veterans’ Domestic Scientific Providers’ Mortgage Fees System, and Illinois National Health Services Corps Condition Financing Payment Program. Each program enjoys additional qualification conditions and offers differing payment number.

Kentucky: The state financing cost plan need an effective fifty-fifty fits from a manager or mentor. Very, per buck during the cost that the system provides, an employer, base, or other benefactor need certainly to suits one amount. If you’re Kentucky’s put-upwards is a bit unique, of numerous county programs carry out require some sorts of company match. Nurses in the Kentucky can take advantage of this program when they work with a keen HPSA for a couple of ages, that can receive ranging from $20,100 and $40,100.

Student loan Refinancing

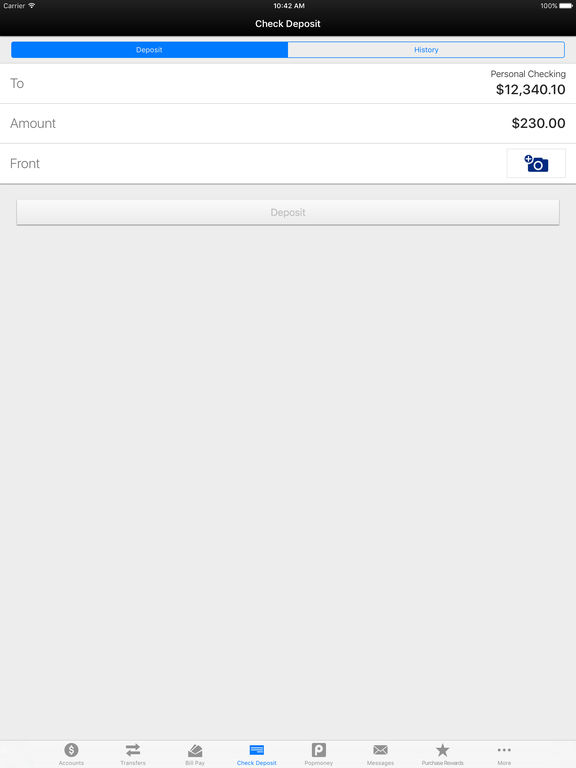

If the education loan forgiveness system won’t look after the your debt (and you may few apps eliminate it completely), it could be worthwhile considering a beneficial refinancing system. Into the an amazing problem, good refinanced financing will allow you to get better mortgage terminology and you can a lower interest, decreasing the collective count you are going to need to spend over time. When you have several money, refinancing may also consolidate her or him and that means you only need to proper care on to make one payment per month.

Refinanced finance try individual funds that will be approved by a bank, borrowing commitment, and other financial institution. The lender takes care of their old mortgage and you can circumstances an alternative you to definitely that have up-to-date terms and conditions and you will rates. Refinancing isn’t for all, however it is advisable to keep on your straight back pouch, particularly when your loan forgiveness system wouldn’t protection much of the latest total price.

Obviously, you can save money in other means, even while you may be however at school. To get utilized textbooks and you may going for reasonable medical scrubs and you will tennis shoes to own breastfeeding will help remain those funds in your pocket very you could potentially place it into the a heightened loan payment.