- Quicker loan recognition odds: Loan providers generally favor borrowers having all the way down DTI rates as it indicates less chance of standard. In case the DTI ratio exceeds 41%, it may improve concerns about what you can do to help you comfortably pay the homeloan payment with your other bills.

- Increased analysis and you may testing: Loan providers will get study your financial situation so much more directly in the event your DTI ratio try higher. Rhode Island check cashing installment loans They may very carefully consider other factors eg credit history, a career stability, dollars reserves, and you will compensating items to determine what you can do to cope with the loan commission.

- Prospect of financing assertion or limits: Specific loan providers could have stricter DTI criteria and may refuse your application for the loan. It only goes if your DTI proportion exceeds the specified limitation. Other people may offer a loan but with specific constraints, particularly demanding a bigger down-payment or battery charging a higher interest rate to compensate into the large identified chance.

- Planning regarding compensating affairs: That have good compensating products, such as a great credit rating, ample dollars supplies, or a stable work background, can increase your odds of mortgage approval even after a top DTI proportion. This type of facts might help decrease the lender’s concerns about your ability to cope with the borrowed funds commission.

If the financial obligation-to-earnings (DTI) proportion exceeds 41% having a Virtual assistant loan, this may perception your loan eligibility and you can approval processes

You will need to keep in mind that given that Virtual assistant sets a max back-prevent DTI proportion tip off 41%, lenders involve some discretion from inside the determining her limitations and you may comparing applications. For each financial might have more conditions and you can flexibility centered on the chance research.

You’ll be able to lower your obligations-to-income ratio having an excellent Va mortgage

In the event your DTI proportion exceeds 41%, you may also envision techniques to lower your DTI ratio, including paying down existing debts, boosting your money, otherwise investigating debt consolidation reduction selection.

Less DTI ratio displays to lenders which you have an excellent more powerful budget and tend to be better able to handle the loan payment together with other costs.

- Pay back present expenses: By the aggressively paying down or paying off a great expenses, you can decrease your overall monthly debt obligations. This may has a life threatening affect cutting your DTI ratio. Manage highest-focus debts very first to increase the new impact on their proportion.

- Boost your earnings: Believe a method to enhance your earnings, particularly trying out another business, freelancing, or pursuing a lot more resources of income. An increase in money will help change your DTI ratio, as long as the extra money was secure and certainly will feel recorded. Be ready to provide proof of this additional earnings to lenders.

- Stop trying out the expense: Stop otherwise avoid getting the brand new bills while you are obtaining a Virtual assistant home loan. Taking on more debts increase the monthly premiums and you will possibly improve DTI proportion. Be careful with the latest bank card apps, automotive loans, and other kinds of personal debt during this time.

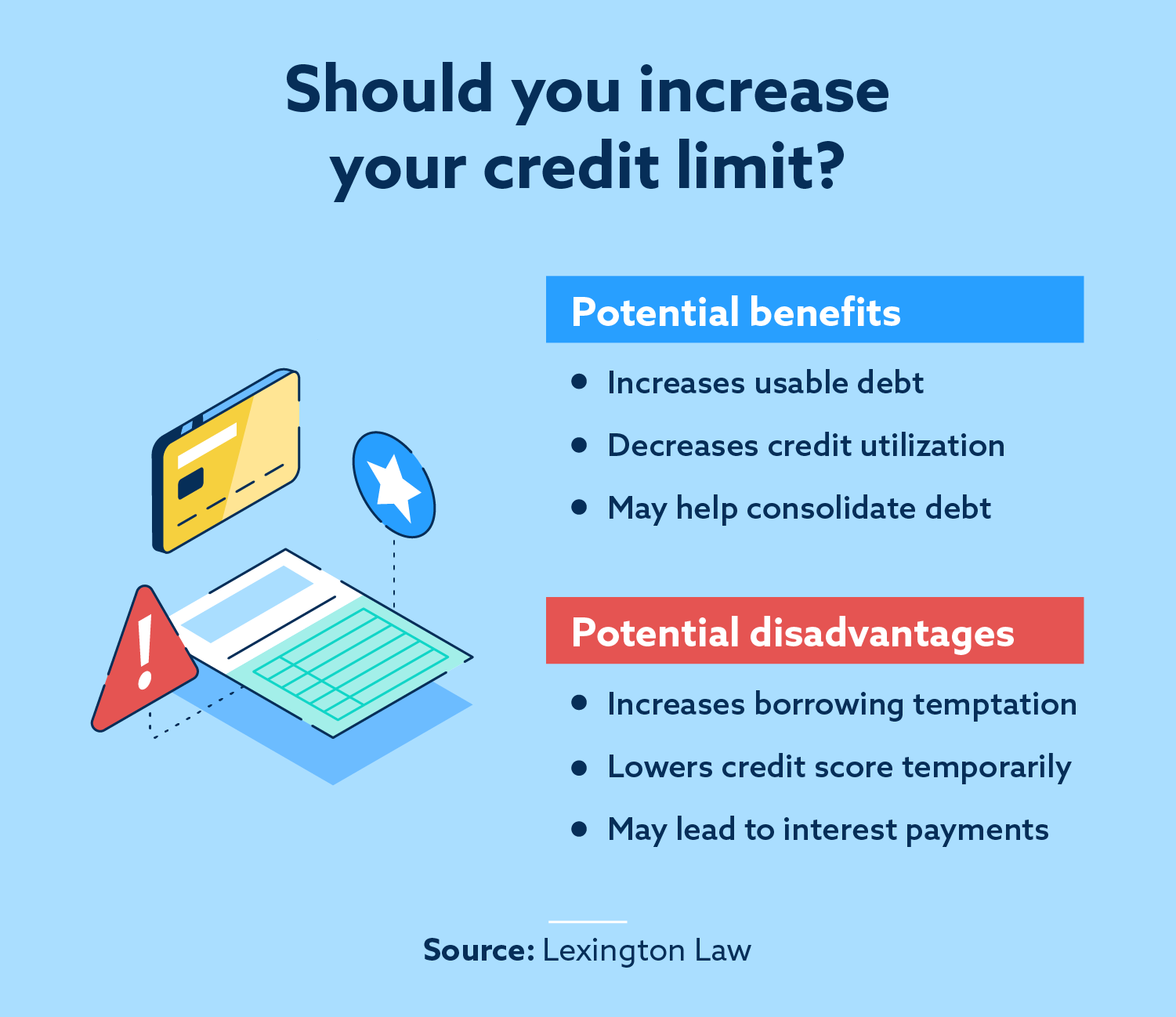

- Debt consolidating: When you have multiple large-attention debts, envision merging all of them into the a single loan that have a lower life expectancy focus speed. Debt consolidation reduction might help improve your instalments and you may probably lower your overall monthly debt burden. But not, keep in mind one costs otherwise costs associated with debt consolidation.

- Enhance your down payment: While it cannot yourself perception your DTI proportion, a much bigger down-payment will help slow down the loan amount and you may, subsequently, the new monthly mortgage payment. This will ultimately reduce your DTI ratio of the reducing the loans load. Preserving to possess a bigger downpayment might be a proper flow to evolve your current monetary character.