The government government’s very first financial put system will help those people which meet the requirements, however, at the cost of individuals who do not, writes UNSW Sydney’s Nigel Stapledon

Which have houses cost set to become a switch election question, new 2022 federal funds develops this new scheme the latest Coalition put forward at the 2019 election to assist earliest homebuyers.

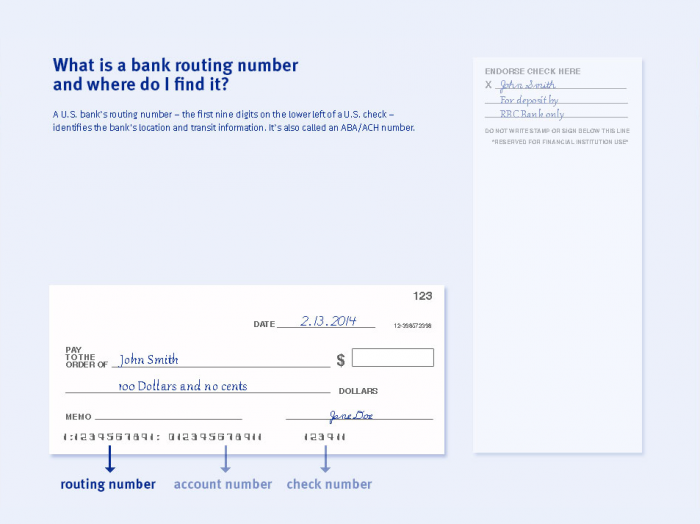

The original Financial Put Plan helps the individuals without the practical 20 per cent deposit necessary for mortgage brokers. For those who qualify, they claims around 15 per cent away from good loan’s value, definition customers can also be safe home financing which have a 5 per penny deposit.

On the 2021-22 economic season new scheme is actually capped within ten,000 urban centers. This new 2022 funds try broadening so it to help you thirty five,000 a-year, together with a supplementary 10,000 metropolitan areas to have basic homebuyers inside the regional areas. It is going to grow a category for solitary moms and dads produced within the the latest 2021 finances, making it possible for particular to go into that have a 2 % put, enhancing the cover in order to 5,000 per year.

Government apps to simply help first home buyers try consistently criticised given that only placing upward tension into the pricing, providing no real benefit to first home buyers. So it design tend to push-up prices, but not from the exact same amount because the worth of the fresh new assistance.

You to side-effect of Basic Mortgage Deposit Design are it artificially forces upwards family cost, making them unaffordable for others. Image: Shutterstock

What is driving right up property costs

Australia’s apparently high houses prices can also be historically getting associated with this new extreme income tax advantages of assets possession and you can rigidities on the also have top, such zoning or any other regulatory restrictions. Previously couple of years, these types of situations was formulated from installment loans no credit check Delta PA the powerful mix of COVID-19 and you may low interest.

This has been an international event, by no means novel so you’re able to Australian continent. The functional-from-family wave induced a rise popular for huge properties and a shift so you’re able to outlying and regional section at the same time because the central financial institutions pressed official rates of interest near to zero to turn on weak economies.

An extra-best bet

The put ensure plan to simply help basic homebuyers is what economists call an extra-best option. An optimal provider manage more in person address this new consult and supply reasons operating up costs. In lieu of this, the newest government’s plan is to promote basic-home buyers a boost more someone else.

Any problem for example a system merely lifts all the ships and you will throws up pressure to your cost isnt somewhat best. It can push-up prices, not because of the exact same matter just like the worth of brand new financing guarantees. To accomplish this the customers will have to get the exact same concession, there would have to be no effect on the production out-of property. Supply regarding the housing marketplace can be sluggish to respond however, it does change with demand.

Over the past a couple of years, basic homebuyers make upwards on 20 % away from every people. So it plan, even after the brand new longer limit, may benefit fewer than half one to matter in the seven percent of all buyers.

And so the program will receive some impact on possessions pricing, not adequate to counterbalance the property value the help to help you the individuals people exactly who meet the requirements. Additionally, those individuals trading home will pay somewhat way more. Very have a tendency to traders, and you can clients in owed path.

The big concern with the deposit strategy is the exposure that the individuals utilizing it to shop for a property are able to enter financial problems and standard on the home loan. Image: Shutterstock

Greater control, higher risk

The major concern about that it strategy ‘s the risk people playing with it to get a house can then go into economic troubles and you may default to their home loan.

This was an adding cause for the us subprime financial drama you to definitely led to the global economic crisis out of 2007-08. Policies made to rating lower-money houses for the business appeared to performs up until the drama struck. Next home costs tumbled and many have been forced to sell during the huge losings.

After you control up, credit 95 percent or 98 % of your really worth out of a home, you are alot more started when the rates slip. Actually a small refuse could more than eliminate the collateral.

Homes is not exposure-100 % free. Time matters. Home costs is also slide including increase. With rates increasing and you can huge globally economic uncertainty, specific negative effects from this program on the track cannot be ruled out.

Nigel Stapledon are a research Fellow in A house on Centre for Applied Economic Browse, UNSW Sydney. A type of this post appeared on Conversation.

You are able to republish this information one another online and inside printing. I query you go after particular effortless guidance.

Delight dont change the new part, remember to trait the author, its institute, and talk about your post is originally wrote for the Providers Thought.