- Financing Financing

- Masters Cons Cross Collateralisation

Score a lesser price today ahead of it’s too-late. Rates of interest which range from 5.99% p.an effective. (6.02% evaluation price) * . Call 1300 889 743 or ask on the web.

Yet not, those people who are even more knowledgeable acknowledge the possibility great things about the latest cross-securitisation means, particularly when you are looking at taxation gurus.

How to qualify?

One guarantor on the any loan from inside the cross-collateralised design are needed to guarantee all financing in cross-collateralised design.

Regarding an authorized loan in which a borrower isnt a good mortgagor, one to debtor need to have an immediate link to an excellent mortgagor, with respect to handle such as owing to a family design, in which a great mortgagor is a manager.

And therefore lenders makes it possible to cross-collateralise?

Lately, the industry regulator, the brand new Australian Prudential Control Authority (APRA), has pressed banks so you can tighten their formula toward resource financing.

Exactly what this has required try stronger mortgage visibility limitations, requiring that provide a whole lot more defense when it comes to collateral or in initial deposit which you have saved yourself.

Please e mail us to your 1300 889 743 or fill in all of our on line inquiry setting to speak with our home loans regarding the resource preparations.

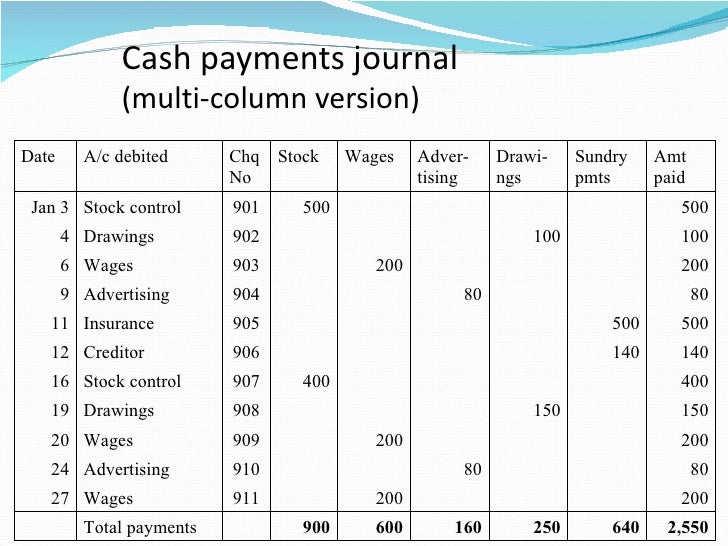

What is actually mix-collateralisation?

That’s where more than one property is put given that safety for a home loan instead of a fundamental home loan where you have one possessions protecting one home loan.

How most property buyers begin is by to find an owner filled possessions and you may strengthening security if you are paying on the mortgage and you may due to market development.

When your Mortgage so you can Worth Proportion (LVR) gets to less than 80%, really loan providers will allow you to availability your collateral, which can be used to acquire a special property instead of being forced to save up a deposit.

It means you really have an LVR off 50% so you’re able to accessibility to 80% of the property worth of readily available guarantee.

In cases like this, you really have 29% of the property value to make use of just like the security or $240,000 (regardless if financial institutions scarcely enables you to use around your limitation).

You might purchase an apartment equipment from inside the Adelaide well worth $190,000 within 100% of one’s really worth https://elitecashadvance.com/loans/10000-dollar-payday-loan/, secure in your financial as well as have cash-out regarding $ten,000 to increase their counterbalance membership.

Contained in this analogy, both qualities are safeguarded by your mortgage, that’s now $600,000 ($eight hundred,000 1st home loan + $190,000 with the unit + $ten,000 cash out).

This can be weighed against the greater cutting-edge strategy of obtaining multiple money safeguarded from the several properties which have probably numerous loan providers.

Note: This situation doesn’t take into account the cost of stamp obligation, lender costs and you will judge expenses associated with to shop for property.

The great benefits of get across-securitisation

Especially, its for many who cannot intend to sell any one of its services soon (no less than ten years approximately) plus don’t anticipate to find significantly more characteristics soon.

You can get a lesser rate of interest

One of the main benefits associated with this tactic gets a great dramatically reduced proprietor filled interest rate in your entire collection due to the fact go against a high investment mortgage price.

This is because specific loan providers will allow you to use you owner filled possessions and you can cross-securitise they with your investment features.

The essential difference between investing something such as step three.80% which have a mortgage speed and you can 4.20% having a good capital loan might not seem like much nonetheless it was!

Such, when you have $2 hundred,000 owing on your own $800,000 domestic at the 3.80% p.a., your total repayments more 30 years will be $335,490.

If you decided to pick a residential property really worth the same since your most recent mortgage ($2 hundred,000) in the cuatro.20% p.an effective., their complete money perform $352,093, or more one to $sixteen,five hundred more three decades.