Wells Fargo Financial, N.An excellent., perhaps not in its individual capabilities however, solely because trustee in the RMAC REMIC Faith, Show 2010-1

Allonge to note indorsed spend for the acquisition away from Wells Fargo Lender, NA perhaps not within the individual capability but exclusively since Trustee to possess the latest RMAC REMIC Faith, Collection 2010-1

From inside the Deutsche Bank Nat

Wells Fargo Lender, N.An excellent., maybe not in individual skill however, exclusively given that Trustee from the RMAC REMIC Faith, Show 20101, by Rushmore Mortgage Administration Services, LLC, their designated attorneyin-facts

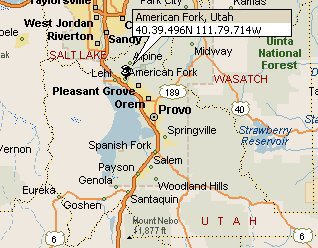

(ECF Zero. 21 at cuatro-5.) On top of that, SPS included new lower than chart summarizing the fresh submitted tasks of your own Deed away from Trust:

Wells Fargo Bank, Letter.A beneficial., maybe not within its private capacity but only because the trustee about RMAC REMIC Trust, Show 2010-1

Wells Fargo Bank, N.A good., not with its individual strength but only as trustee on RMAC REMIC Trust, Collection 2010-1

SPS and you will Rosenberg insist one to Towd Section is the holder from this new Notice, and therefore named them to gather towards the Financing and you will institute foreclosure procedures, which Plaintiff’s updates on the other hand results from her misunderstanding regarding Maryland legislation. (ECF Zero. 14-step 1 from the 4; 21 from the thirteen.) The latest Ailment alleges the Note contains an email Allonge that shows an acceptance off Wells Fargo Lender, Letter.An excellent., Daleville loans in its capabilities since the only Trustee towards the RMAC and you can REMIC Faith, Series 2010 from inside the empty. (ECF Zero. step 3, 18i.) SPS and you can Rosenberg demand he or she is permitted assemble and demand Plaintiff’s Loan (on the part of Towd Area) just like the Mention includes an enthusiastic indorsement when you look at the blank; and are the new proprietors into the fingers of the Notice. (ECF Nos. 14-2 from the 5; 21 at the 15.)

Indeed, such as for instance trusts have been called special-purpose automobile while they just contain the funds treated by trustees and compiled of the financial servicers

For the determining the parties’ states and you will objections, the fresh court discovers they helpful to feedback the securitization procedure of the loan world. The latest securitization procedure are really-paid when you look at the

Securitization begins when a mortgage founder sells a mortgage and its particular note to a buyer, that is typically a part off a financial investment financial. New resource lender packages together new great number of mortgage loans it purchased into the a good special purpose vehicle, always in the form of a rely on, and you may sells the funds legal rights some other traders. A good pooling and you can servicing arrangement kits several organizations that take care of the trust: an excellent trustee, which manages the mortgage property, and you may a great servicer, exactly who communicates that have and you can accumulates monthly installments in the mortgagors.

Tr. Co. v. Brock, that it Legal explained you to a beneficial special purpose vehicle is a corporate organization that is entirely a databases toward loans; it does not have employees, organizations, otherwise possessions aside from the fresh new funds it sales.’ 430 Md. 714, 718, 63 An effective.3d 40 (2013) (estimating Anderson, 424 Md. from the 237 letter. 7). See along with Christopher L. Peterson, Predatory Planned Loans, twenty-eight Cardozo L. Rev. 2185, 2261 (2007) ( Inside the a routine deal, an authorized business is rented to help you provider the loan – meaning

gather the debt. A customers does not have the right to won’t perform providers which have a pals offered maintenance liberties by the an effective securitization pooling and you can upkeep contract.)

The fresh securitization process of the mortgage industry features you to definitely a confidence, such a different legal faith, provides a certain mission in the mortgage industry. Select Deutsche Lender, 430 Md. at the 718. To put it differently, the newest trust entirely constitutes a pool regarding finance that can ultimately feel sold over to buyers. Discover [Peterson, twenty eight Cardozo L. Rev.] in the 2209. The fresh new trustees and you will replacement trustees are the stars one create and you will handle the latest believe possessions. Get a hold of Anderson, 424 Md. during the 237. The mortgage servicer, rather than the legal faith, acts as your debt enthusiast and you can interacts towards borrowers. Select Peterson, twenty eight Cardozo L. Rev. at the 2261.