The new Fees Calculator are often used to select the fees count or amount of costs, such as for instance playing cards, mortgages, auto loans, and private money.

Result

Fees is the operate regarding paying back currency in earlier times lent off a lender, and you can failure to repay obligations could easily push one to declare themselves bankrupt and/otherwise seriously affect credit rating. New costs off individual money are made in occasional money that are included with some prominent and appeal. Regarding the calculator, there are 2 fees times to pick from: a predetermined mortgage name otherwise a predetermined fees.

Fixed Loan Term

Prefer this option to go into a fixed loan name. For instance, the new calculator can be used to see whether an excellent 15-season otherwise 31-season home loan can make a lot more feel, a common choice many people need to make when purchasing a great domestic. New calculated overall performance often monitor the fresh new month-to-month repayment needed to shell out off the mortgage for the given mortgage title.

Repaired Installment payments

Choose this option to get in a predetermined amount to be distributed monthly through to the financing and you will appeal try paid in full. The brand new calculated efficiency tend to screen the loan label needed to spend off of the loan at this monthly fees. As https://cashadvancecompass.com/payday-loans-wi/ an instance, which ount away from throw away income determined by subtracting expenses away from earnings which can be used to expend back credit cards equilibrium.

Regarding the U.S., all the consumer loans are prepared becoming repaid monthly. The following are four quite prominent finance.

Mortgages

Throughout the U.S., mortgages must become repaid monthly using repaired or varying rates, if you don’t transformed from one to the other during the lifestyle of your loan. To own repaired-rates mortgages, the fresh month-to-month cost count is restricted regarding the financing title. Consumers can decide to expend alot more (although not shorter) than the expected cost number. Which calculator does not believe varying rates money. To find out more, use the Mortgage Calculator.

Auto loan

Such as for example mortgage loans, automotive loans have to be reduced month-to-month, usually on fixed rates. Individuals may choose shell out far more (but not shorter) compared to required cost matter. For more information, utilize the Auto loan Calculator.

Figuratively speaking

In the united states, the government now offers authoritative agreements that will be tailored specifically with the repayment off federal student loans. Depending on the individual debtor, there are installment plans which can be money-established, preparations one to offer the definition of of your own loan, otherwise preparations especially for mothers otherwise graduate pupils. Fees of most government student loans should be put-off for some point in tomorrow. Federal offered repayment plans are going to be longer around 25 years, however, understand that this can produce a whole lot more interest given out overall. To find out more, utilize the Student loan Calculator.

Playing cards

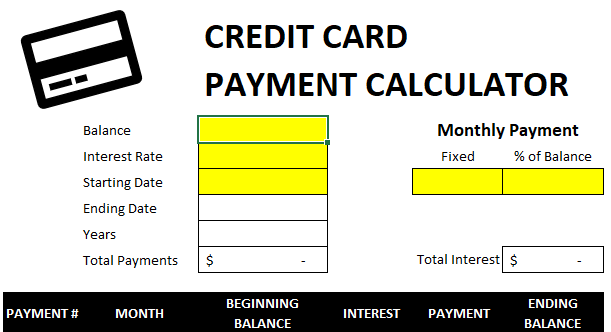

Bank card funds are thought revolving credit. Brand new payment away from handmade cards differs from normally arranged amortized financing. While the latter needs an appartment add up to be distributed an excellent week, the newest installment out-of revolving borrowing from the bank is far more versatile in this the matter can vary, though there was a minimum payment due on every mastercard each month that really must be met to end punishment. To learn more, make use of the Charge card Calculator.

How-to Pay off Money Quicker

If you have no prepayment punishment in it, any additional currency heading toward that loan would-be familiar with lower the prominent amount due. This can automate the amount of time in which the principal due in the long run is located at zero and decreases the number of interest due while the of quicker dominant count that’s due.

To possess loans which need month-to-month payments, submission 1 / 2 of this new monthly payment the two weeks as opposed to you to definitely payment is also automate new repayment regarding finance during the a couple means. To begin with, reduced overall attract have a tendency to accrue once the costs usually decrease the principal harmony more often. Next, biweekly repayments having a complete seasons commonly equal twenty-six annual costs since there are 52 days for the a year. It is comparable to to make 13 monthly installments a year. Prior to making biweekly repayments, ensure that there are no prepayment punishment inside it.

Loan refinancing relates to taking out a different loan, usually with increased good terminology, to restore an existing loan. Individuals is refinance their funds in order to less terminology to repay the latest financing shorter and you can save on attract. not, borrowers normally need to pay refinancing charges upfront. These types of charges can be quite large. Make sure to evaluate the positives and negatives before you make the latest refinancing decision.

New methods over is almost certainly not appropriate for everyone loans. As well as, you should to check on if or not paying off money smaller is in reality smart economically. And then make even more costs towards your financing are perfect, they aren’t essential, there was chance will cost you one to deserve planning. For instance, a crisis fund will come during the handy whenever incidents such as for instance scientific emergencies or automobile accidents happen. Actually holds one to succeed throughout a great ages much more economically helpful than simply additional payments toward a low-attract loan.