You can re-finance a home guarantee loan by substitution they which have another you to definitely, tend to that have top terminology. However, settlement costs and you can stretched terms can get boost complete appeal. Even so, refinancing can save you money through the years.

By the Zachary Romeo, CBCA Assessed by the Ramsey Coulter Modified from the Venus Zoleta By Zachary Romeo, CBCA Examined by the Ramsey Coulter Edited by the Venus Zoleta About this Page:

- Might you Refinance an enthusiastic He Mortgage?

- As to the reasons Refinance a keen He Loan?

- Trick Considerations

- Procedures to help you Refinance a keen He Financing

- Possible Downsides

- Refinancing Choices

- Cash-Aside Refinance vs. He Loan

- FAQ

A property security mortgage enables you to borrow against this new guarantee when you look at the your home, providing a lump sum payment having repaired costs and an appartment appeal rate. Refinancing helps you safer a lowered rates or to switch your mortgage label to own easier costs. Know your options in addition to potential benefits before carefully deciding.

Trick Takeaways

You might re-finance a home equity mortgage to safe finest conditions, for example a reduced interest or higher flexible repayment possibilities.

Do you really Refinance a home Equity Financing?

Maria, an image developer, took aside property security financing 5 years before so you can renovate their unique cooking area. Having rates of interest now all the way down, she miracle if the refinancing could help remove their own monthly obligations.

Refinancing changes the outdated loan with a brand new you to, usually that have most readily useful terms and conditions such as for example a lower rates otherwise a longer repayment several months. Getting Maria, this could imply protecting to the attract otherwise adjusting their particular mortgage so you can most useful suit their budget.

Refinancing a property guarantee financing is different from mortgage refinancing. A home loan re-finance changes much of your financial, when you’re refinancing property collateral mortgage alter just the terms of the new additional loan linked with your own home’s security.

A mortgage refinance allows you to to alter along your loan. You can continue the expression to lower monthly obligations otherwise reduce they to settle their mortgage quicker. That have a property equity loan re-finance, just the percentage of equity you’ve lent up against was impacted, leaving the majority of your home loan unchanged.

Rates together with differ. Mortgage refinances usually have lower cost since they are linked with your own top mortgage, when you’re refinancing a house equity loan may come which have higher cost because the it is a smaller sized supplementary mortgage.

As to why Re-finance a property Equity Mortgage?

Refinancing property collateral mortgage is reasonable in a lot of points. It’s choices that match your most recent requires, if to have better words or higher freedom. Here are four common explanations you might want to refinance an effective home equity loan:

All the way down interest rates

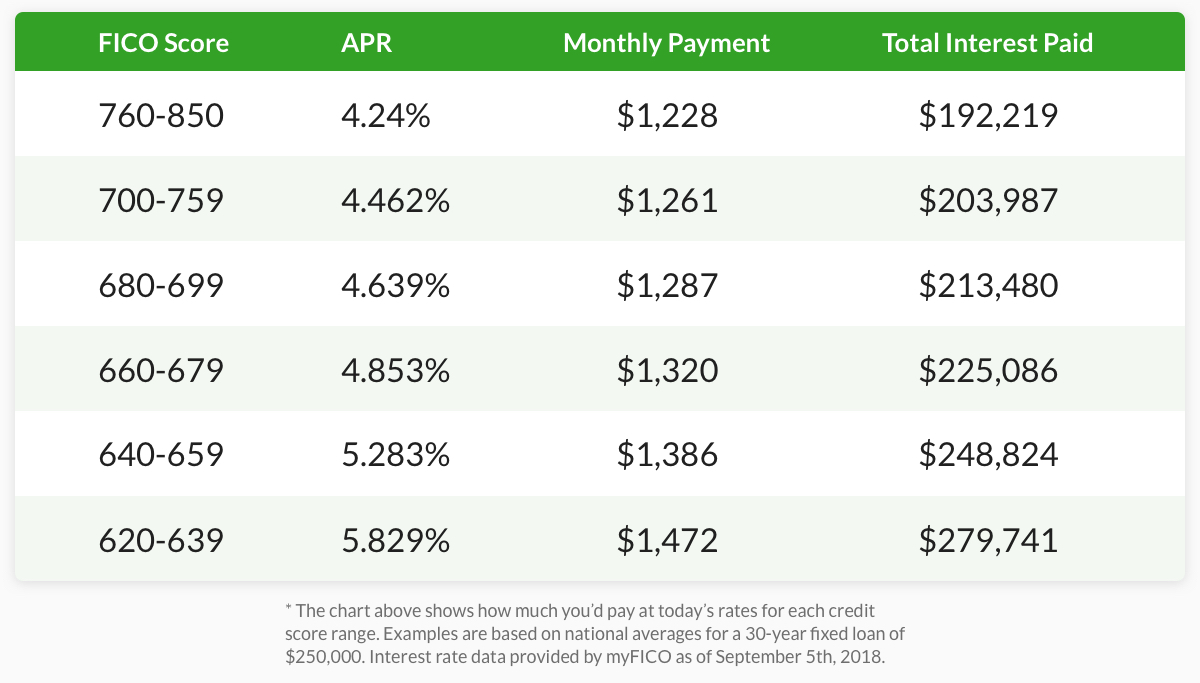

Refinancing could reduce your interest repayments in the event the field prices features decrease as you earliest took out your loan. Such, for those who very first lent at the 6% and you will costs features dropped so you’re able to cuatro%, good refinance will save you currency through the years.

Down monthly obligations

If you’re experiencing monthly premiums, refinancing towards the a longer-identity mortgage may help cure all of them. By way of example, stretching the word off 10 to 15 age carry out reduce your can cost you, making them a whole lot more down.

Switch of variable to help you repaired pricing

In the event the latest family collateral mortgage possess a changeable rates, consider locking during the a fixed price by way of refinancing. This would make you foreseeable monthly installments and you may protect you from possible price develops.

Accessibility more income

If your residence’s worth has increased, you could re-finance and you may use a whole lot more facing your own security. Like, refinancing can be open additional equity if you’d like money for an excellent large debts such as for example domestic solutions or studies.

Combine financial obligation

Refinancing makes you combine highest-notice costs towards the you to definitely fee. As an example, you should use their refinanced mortgage to settle playing cards, simplifying your money and you will potentially minimizing total interest costs.