The modern household collateral loan pricing within the Alabama for ten-year fund average 8.2%, compared to the federal price from 7.7%. Getting 15-12 months finance, an average is actually 8.4%, because the federal speed really stands during the seven.9%.

From the Zachary Romeo, CBCA Reviewed by the Ramsey Coulter Edited of the Lukas Velunta By Zachary Romeo, CBCA Reviewed from the Ramsey Coulter Edited because of the Lukas Velunta With this Page:

- Newest AL HEL Cost

- AL HEL Costs of the LTV Ratio

- AL HEL Prices by City

- AL HEL Lenders

- How to get a knowledgeable HEL Rate

- FAQ

The guarantee of your home that you could supply and borrow is called tappable equity. A property collateral financing (HEL) can help you maximize your home guarantee, whether you’re trying money home improvement strategies otherwise combine loans.

Alabama’s home security financing prices is significantly more than federal averages – 8.2% Apr to own an excellent ten-season identity (7.7% nationally) and 8.4% Apr for a good 15-seasons term (7.9% nationally). We’ve got built-up outlined insights on the most recent home guarantee mortgage prices when you look at the Alabama, in addition to area-particular prices, most readily useful loan providers, and you can great tips on protecting the best prices for using their residence’s security.

Key Takeaways

High LTV ratios trigger higher pricing. The typical an among an 80% LTV was 8.3%, compared to the 8.6% for good ninety% LTV.

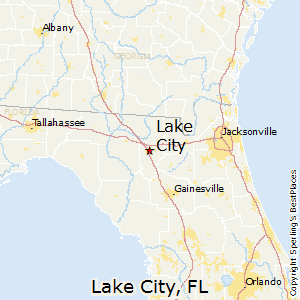

HEL costs are different of the city in Alabama. Including, getting 15-season fund, Millport provides the typical Annual percentage rate out of 6.0%, whereas Midfield’s was 10.7%.

Other loan providers render different cost for the same financing brands. Western Alabama Financial & Trust’s average Annual percentage rate try six.0%, whereas PNC Bank’s try 10.4%.

MoneyGeek checked twenty seven more banking institutions and you may credit unions for the Alabama having fun with S&P Global’s SNL Depository Rates dataset to remain current to your most recent house security financing pricing.

Latest House Guarantee Financing Cost when you look at the Alabama

The modern mediocre an excellent is 8.4%, but several circumstances you will apply to just what lenders promote. Such as, a high credit history can also be secure your a lower life expectancy ount might end in a higher level. Repayment terminology is a different thought. Have a look at desk examine the current domestic guarantee loan rates from inside the Alabama around the additional financing terms.

Rates getting property security loan transform daily. Keeping track of these types of rates helps you shell out shorter into the attention over the lifetime of the mortgage, saving you money. For those who have higher-attract expenses, a home security loan at the a lesser rates will help consolidate men and women expense and reduce your current how to get a loan Mead attract money.

Particularly, an excellent $50,000 household equity financing which have a good fifteen-year title at the a keen 8.4% Annual percentage rate leads to a payment per month of $489 and you may a complete focus from $38,100. In contrast, a ten-season loan which have an 8.2% Apr has a payment per month off $612 and you may a complete attention regarding $23,432.

Domestic security financing and domestic collateral credit lines (HELOC) is actually popular options for home owners so you’re able to tap into its home’s collateral. Home security loan pricing from inside the Alabama possess repaired rates, averaging 8.2%, while HELOC rates in the Alabama are variable, averaging 8.3%.

Repaired costs mean uniform monthly obligations, providing financial predictability. Variable costs may start down but can boost, ultimately causing higher costs through the years.

House Equity Financing Rates by the LTV Ratio

The interest rate you be eligible for relies on the loan-to-well worth ratio, that’s how much cash you borrowed on your financial as compared to your residence’s appraised well worth. So you can calculate their LTV ratio, divide your current financial equilibrium by the home’s appraised worthy of and you can multiply because of the 100. Eg, should your home is cherished at the $3 hundred,000 and you also are obligated to pay $240,000 in your home loan, their LTV ratio is actually 80%.

A high LTV ratio mode higher possible exposure so you can loan providers, resulting in highest rates. Currently, an average a having a keen LTV proportion regarding 80% was 8.3%. It is 8.6% to possess an LTV proportion regarding ninety%. Utilize the table observe what mediocre domestic security mortgage prices you could potentially be eligible for considering the LTV proportion.