To acquire a special framework home during the 2024

The fresh new construction house enjoys updated floor agreements and you may products, wanted less restoration, plus they are have a tendency to more opportunity-efficient. Let alone, the brand new build may appear appealing in the current markets, in which existing virginia homes can be found in small supply.

Although not, the process of to order a newly depending home is somewhat some other of to order a current family. Here is what you must know one which just dive from inside the.

A freshly created household can offer flooring plans and styles that suit your concept. But though some aspects of such purchases are like buying a current domestic, other parts of your own process disagree.

1. Rating a real estate agent

Home agreements is cutting-edge regardless if you are to find an alternative home otherwise a current house. So it’s crucial that you work with the right realtor.

A real estate agent may help discuss the price into the builder and you may respond to questions you may have regarding the process. Generally, the creator pays the true house agent’s payment. So you need not value paying your own Agent out away from wallet at the conclusion of the afternoon.

2. Rating pre-acknowledged for a loan

Realtors generally wanted a beneficial pre-acceptance letter before you can generate a deal on a separate structure family. This requires calling a home loan company to see if you meet the requirements getting a home loan. Pre-approvals get rid of the guesswork and watch what you are able be able to invest in a home.

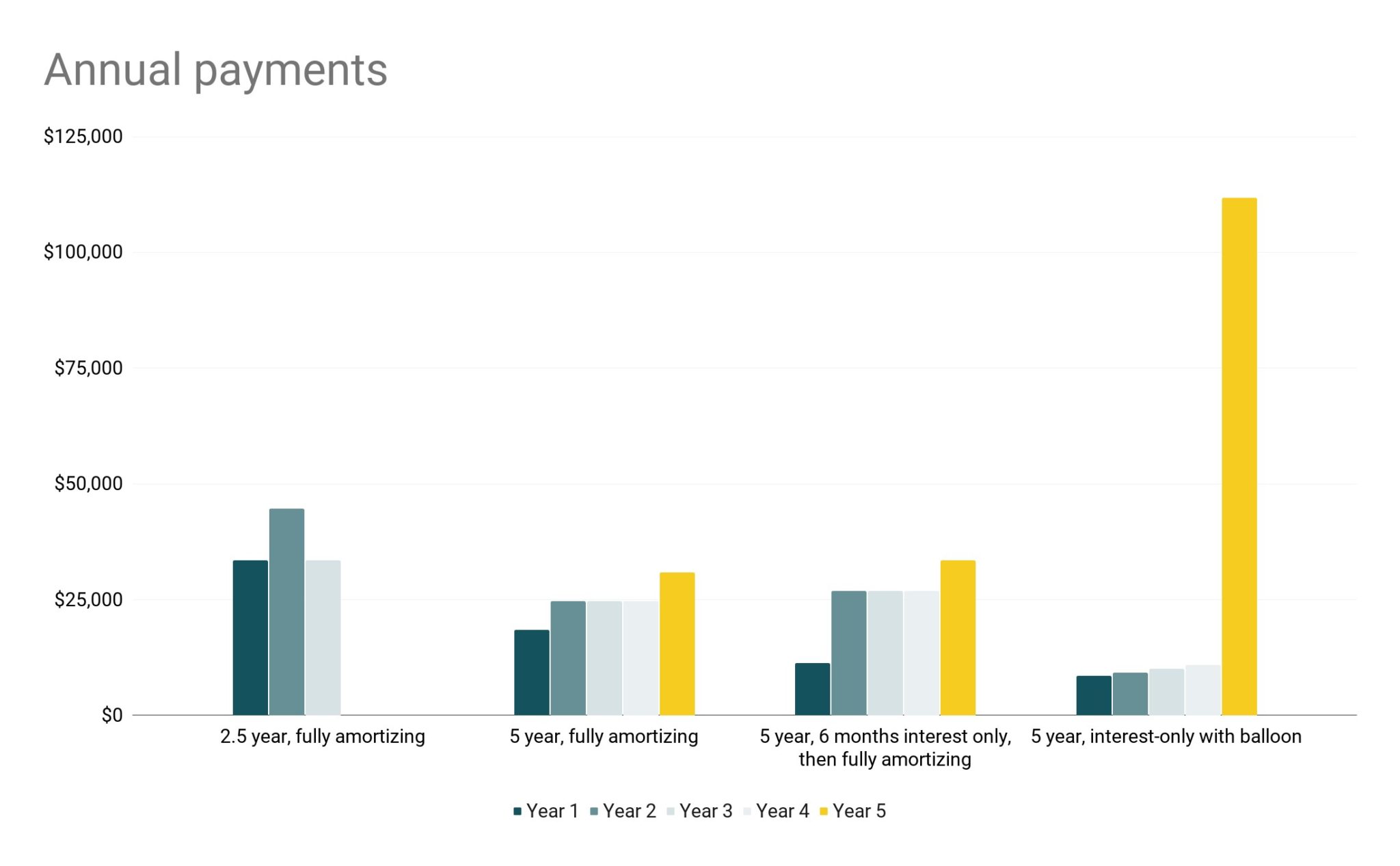

Your own lender may also highly recommend an informed sort of capital to possess an alternate make. This will vary according to type of the brand new build and you may the type of creator you are handling.

3. Choose the best variety of family and you may creator

Discover different varieties of the newest structure functions, so that you have to choose the best type of creator. The yields become area, specification (semi-custom), and personalized property.

- System land was characteristics mainly based in this another invention or subdivision. New creator orders a giant area away from home and constructs home for each package (you decide on their lot)

- Which have a spec household, a creator chooses the designs and you may floor bundle, produces the house or property, right after which sells a change-in-ready family. Some specification house is actually semi-custom, definition you could prefer some of the finishings

- A bespoke home, likewise, is completely personalized. The brand new builder constructs our house towards specifications on your own home

The kind of the fresh build household you intend to americash loans Hazardville invest in have a tendency to apply at the timeline and you will financial support. Therefore focus on your Agent directly to check on the options and you will select the right version of family for the disease.

4. Schedule a pattern visit

Shortly after opting for a builder, you can plan a routine consultation. When you find yourself to shop for an area household, you are able to like the ground package, flooring, cabinets, decorate, or other structure has actually.

Area belongings have limited construction selections compared to the personalized home. Such, an area household creator may not bring hot flooring, while this particular feature will come in a custom home.

Some spec house are completely based and you will tailored prior to they’re listed obtainable. In this instance, you may be not able to make adjustments.

5. Indication a creator bargain

Immediately after you might be pre-accepted for a loan and you can you have opted a creator, possible indication new builder deal to begin with framework on your own domestic.

It package comes with a reason of the house, the fresh new estimated timeline, the price, payment schedules (if appropriate), warranties, and the like.

6. Complete your own home loan and commence design

Based on the loan system and style of the brand new construction household you may be to find, capital can play out several various methods. You might close on a casing-simply financing before the create and then take out a beneficial separate home loan due to the fact home is done. Or, you will be able to use a-one-time-intimate loan that converts away from a houses loan so you can a permanent mortgage.