Article Guidance

When you find yourself to purchase or refinancing property, you may have to plan for financial reserves, which are additional money property you should use to cover the month-to-month mortgage repayments. Understanding how in order to satisfy cash reserve conditions (if they are expected) can make to own a smoother purchase otherwise refinance mortgage feel.

Exactly what are home loan reserves?

Financial reserves – often referred to as bucks reserves otherwise water financial reserves of the lenders – is actually property that may be with ease converted into dollars. Well-known bucks investment is money in your checking otherwise saving membership.

- Withdraw funds from an account (such as a financial or on line savings account)

- Sell a secured item (particularly a car or truck otherwise stock loans)

- Get financing vested in later years or believe levels

- Borrow funds out of a beneficial 401k otherwise bucks-worth life insurance coverage

Cash reserves standards are based on a flat quantity of months’ property value month-to-month housing money a debtor need to have available just after closing. Lenders utilize the whole monthly property expense (together with your prominent, notice, property fees and you will homeowners insurance (PITI)) and you can mortgage insurance rates you only pay and home owners organization and you will condominium charges. Reserves may be needed on the financial purchase fund otherwise re-finance financing.

What type of property satisfy mortgage set-aside conditions?

- Examining or deals levels

- Funds into the securities, holds, money sector loans, common money, permits out-of deposit or believe accounts

- Vested funds when you look at the a pension loans

- Dollars value in the a life insurance coverage

- Something special out-of a relative or friend (having old-fashioned finance just)

Whenever is actually mortgage reserves required?

The necessity for cash reserves may differ with respect to the reason for the loan, the kind of assets you happen to be investment, your credit ratings, debt-to-earnings (DTI) ratio together with financing system. In most cases, an automatic underwriting program identifies just how many months’ worth of supplies you need. All the way down credit ratings (700 otherwise straight down), low-down payments and you can increased DTI proportion (significantly more than 36%) usually are a meal to have requiring deeper financial reserves.

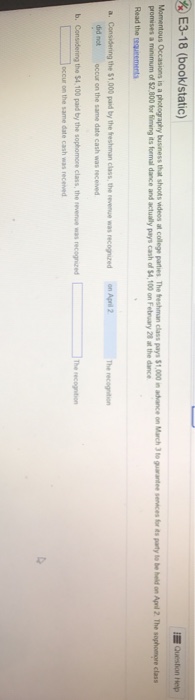

The latest table lower than shows exactly how credit scores, DTI ratio and you can advance payment make a difference just how much you will want getting reserves with the a traditional purchase or home mortgage refinance loan to possess an effective single-home:

Mortgage set-aside criteria according to loan program

Government-backed mortgage system set-aside criteria are very different out-of antique financing advice. You’re going to be needed to establish extra money supplies while you are to get a-one- to-four tool assets, although you’re going to be residing among the systems due to the fact most of your home. When you’re taking right out financing backed by the newest Government Construction Management (FHA), You.S. Department away from Experts Points (VA) or You.S. Service from Farming (USDA), the brand new dining table below information just how much you might need in order to budget for money supplies.

Home loan supplies according to research by the final number regarding easy installment loans Vermont financed homes

If you are building an investment portfolio, lenders require cash supplies based on a portion of financing balance secured by the amount of rental characteristics you possess, unlike a-flat amount of monthly obligations. The fresh percent try detailed below:

5 an approach to boost your home loan supplies

Automate the savings schedule Get a hold of some your income so you can yourself deposit into your checking account on every pay-day – you might also set up automatic repeated deposits out of your checking into checking account through your lender or borrowing from the bank union.

Decrease your costs Look at the plan for a way to slim their paying. Cancel subscriptions the things not play with (particularly membership features otherwise a premier-level cable plan), and you may cut back on eating out and response looking.

Pick up a part hustle. For people who earn more, you can save a lot more. Consider doing an area hustle, particularly freelance composing or tutoring, to help you complement your current income and you will add to your deals.

Think about their windfalls Every time you rating a plus from the workplace, a tax reimburse or other financial windfall, divert some or all of those financing towards the family savings.

Track your inventory alternative and later years account Limited inventory selection can be utilized into set aside requirements immediately following they are vested. Don’t neglect to include the 401k balance on your application for the loan – it may help your coverage requisite financial supplies as much as possible show you are permitted to obtain otherwise withdraw money from brand new account.