About bank mergers, the brand new businesses must take into account the comfort and requirements away from organizations. The newest firms, but not, merely think about the requires to possess deposit account, rather than borrowing from the bank need. Senator Proxmire said: The fresh new government lender regulatory businesses enjoys significant determine more than loan providers. One of the many vitality is the power so you can accept otherwise refuse programs to own deposit business https://elitecashadvance.com/installment-loans-az/phoenix/. Persons aspiring to organize a lender or offers institution need to implement to own a charter. The fresh new agencies, however, dont completely demand its dictate more finance companies. Senator Proxmire went on:

AS&T got issued simply five mortgages regarding ANC communities during the a four-year period of time

The government keeps thus conferred good economic gurus for the personal establishments in the place of wearing down any significant quid pro quo into social. Other regulatory agencies have not been given that bashful whenever awarding charters. Nevertheless other hand of coin-the financing need of one’s locality together with applicant’s ability to provider such needs-had been nearly overlooked because of the regulating providers.

Senator Proxmire proclaimed on to the floor of your own Senate you to The content available with [the HMDA] cure a doubt one redlining indeed is present, that many credit-deserving elements try declined money

Several witnesses within the three days away from hearings into the CRA explained one banks were not fulfilling the requirements getting credit for the communities out of colour and working group neighborhoods. Its descriptions away from unmet borrowing need made a compelling situation one the general public business needed seriously to intervene to treat field flaws and you may hurdles to gain access to to borrowing from the bank.

In his testimony, known consumer safety endorse Ralph Nader offered statements away from Advisory Area Commissioners (ANC) for the Arizona D.C. regarding your traps area owners encountered in the being able to access borrowing. Community customers trying to domestic get loans from banks tend to was required to set out twenty-five percent off costs, that happen to be prohibitive in many instances. The area owners following had to trust new substandard option out-of home loan businesses. Home loan businesses foreclosed faster than banking companies whenever borrowers dropped behind. In addition to, reliance on financial enterprises hampered neighborhood locations. Financial people usually put FHA covered mortgages. These fund frustrated domestic sellers from providing house to community residents since the FHA called for providers to pay products for the loan.

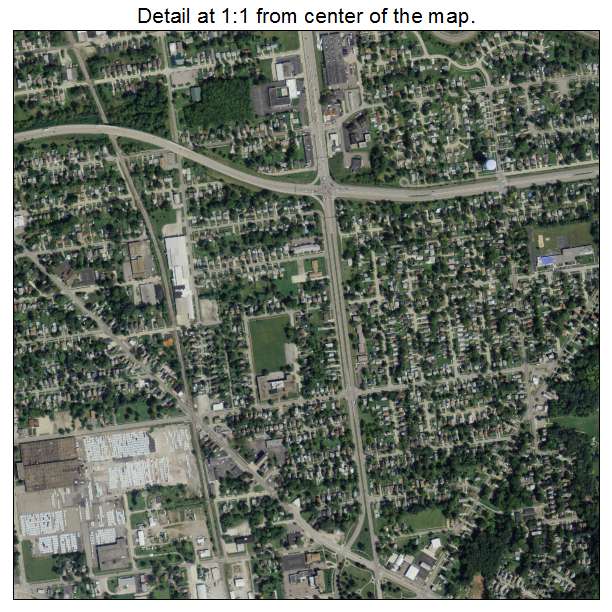

Small enterprises and encountered frustrations from inside the securing loans. For the a study away from seventy-four small enterprises inside ANC neighborhoods, merely 12 per cent got financing whenever you are forty-9 per cent attempted unsuccessfully to try to get finance. Banking companies was in fact fundamentally maybe not tuned in to neighborhood borrowing means. For example, branch personnel in 2 Because&T twigs told people customers that they didn’t have new power and work out mortgage loans. If you’re shunning the ANC areas to the west of Material Creek Playground, the school generated vast amounts from mortgage loans east out of the newest playground inside rich and you may Caucasian communities.

Bank reluctance supply inexpensive financing in the teams from colour taken place all over the country. Gale Cincotta out-of Federal People’s Step chatted about a good 1975 learn from Northwestern University documenting racial disparities in the lending during the il communities. Hispanic citizens of your Logan Rectangular community was required to trust high off-percentage FHA financing if you are mostly white customers from a surrounding area received low down fee traditional financing.

Senator Proxmire and witnesses on reading had access to the fresh analysis necessary for our home Financial Disclosure Operate (HMDA) passed for the 1975 you to effectively reported stark racial disparities into the credit persuasive policy responses and you can step. This assertion out of credit, even though it is not truly the only cause of our metropolitan problems, definitely aggravates urban decline. The guy noted one thorough HMDA research studies revealed stark lending disparities across the country. Including, press in New york exhibited several records citing that merely eleven % of one’s deposits inside the Brooklyn remained inside the this new borough when you find yourself eighty-9 percent is loaned outside the borough. Furthermore, ninety % of places in the District regarding Columbia neighborhoods was in fact loaned in other places. It pattern are regular into the Chi town, Los angeles, and St. Louis.