- Money information instance a financial report, tax come back, or a cover stub

- Financial statements, for those who have a moment home loan, you will want which too

If they are not, you could potentially look around if you don’t get a hold of a loan provider which is acknowledged. You could contact HARP financial in person for both Freddie Mac computer otherwise Frannie Mae.

After you have located a HARP recognized financial, you could start the application techniques. You can do this on the lender’s workplace or on line. It functions same as a vintage mortgage app really does, and this refers to in which you may need any qualifications and you can income evidence.

When you finish the HARP app techniques, the financial institution can look along the app. Might contact your once they you prefer some thing after that so you can techniques the software. Which entire process would be to grab up to 30 days to-do, along with your financial have a tendency to show you through this whole process.

HARP Initial Costs and Closure Schedules

Rather than many other mortgage loans, you shouldn’t spend a lot of upfront will cost you having an effective HARP refinancing system. The actual number of the initial prices varies from lender so you’re able to financial and your situation. You can need to pay for a credit card applicatoin percentage, closing costs, closing costs and you may household appraisal.

While thinking about refinancing beneath the HARP system, you are not having enough big date. To the closure big date for it refinancing system try offered so you can . You won’t want to hold back until the past minute to begin this action should you come upon trouble otherwise delays.

Average Deals with HARP Refinancing

As right amount of savings anybody educated just after refinancing their house may differ, we are able to average all of them. Approximately normally, refinancing your house home loan which have HARP protected about $174 thirty days, and therefore number to $2,088 annually. After you imagine more 3.cuatro million individuals averaging more than $2,000 a year when you look at the savings, which is a staggering matter.

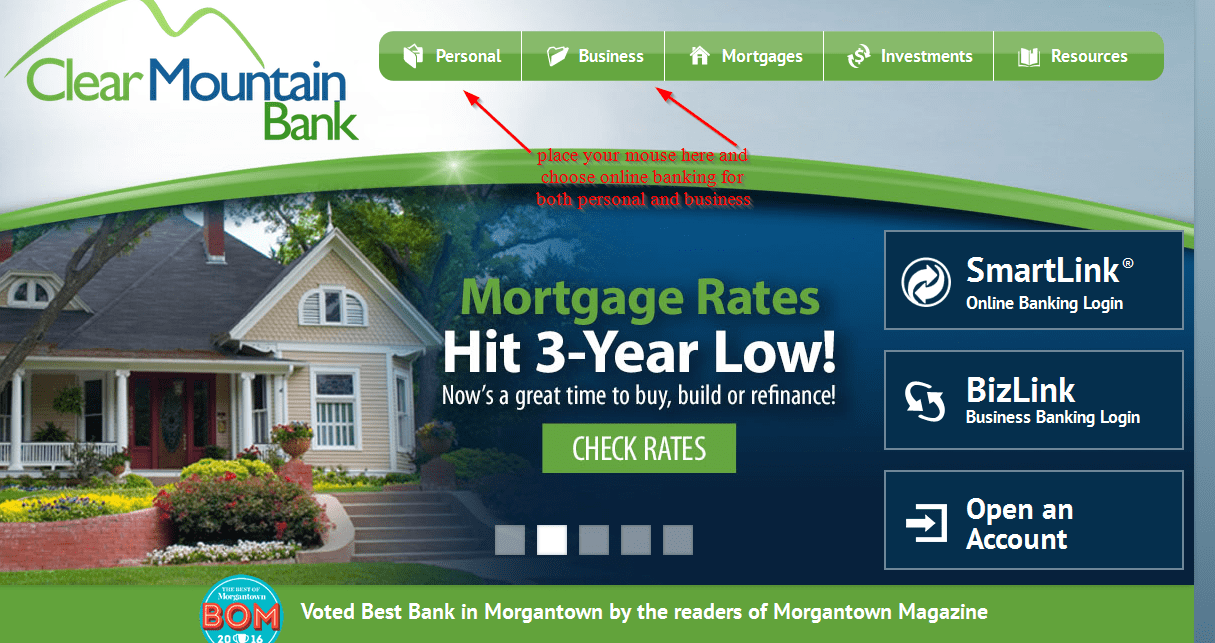

HARP Acknowledged Lenders

While it is true that of a lot lenders try recognized for HARP refinancing, you may have to check around if you don’t choose one you to is good to suit your disease and requires.

- Bank Mutual – That it lender has the benefit of HARP refinancing as they are already recognizing the fresh new HARP individuals. You can visit the website otherwise phone call (800) 261-6888 first off new refinancing procedure.

- Chase Financial – You can purchase your own mortgage refinanced from HARP program with Chase Financial. You may either head to the website otherwise phone call (866) 550-5705 first off the program techniques.

- Quicken Finance – So it lender also provides HARP refinancing to help you the new and newest loans Black Forest people. You could inquire about refinancing your own mortgage by going to their website otherwise calling (800) 971-1622.

- Wells Fargo – Wells Fargo is just one of the large lenders who ensure it is HARP refinancing. You can visit them from the their site or you can telephone call (866) 898-1122 to find out more suggestions.

Benefits of the fresh HARP Refinancing Program

Choosing to refinance you reside a huge action, and you’ll really think regarding the positives and negatives from performing this. This new HARP refinancing system has of a lot self-confident products having home owners trying to re-finance.

Straight down Monthly obligations: One of the first factors of many property owners want to make use of HARP so you’re able to re-finance is for the lower monthly premiums. The payment per month might possibly be influenced by the earlier in the day percentage background along with your credit rating. For those who have a higher credit rating and you will good credit history, you can be eligible for excellent payment terms minimizing numbers.

Most readily useful Financial Terms and conditions: Once again, this will depend on your own credit score and your payment history, however you certainly will qualify for all the way down pricing along side longevity of your mortgage. You can get free refinancing and lower rates once you refinance. It’s the possibility to store you a lot of money.