Preciselywhat are The current Domestic Rates of interest inside Grand Rapids?

Below try home financing rates of interest graph* to own rates style from inside the Huge Rapids, Michigan. The fresh cost here are to possess academic motives only. Showed figures indicate manner and are generally maybe not pricing offered by Treadstone Funding to virtually any kind of debtor, once the rates of interest are affected by activities along with borrowing, loan amount, and more.

*Displayed interest levels show world trends, plus don’t depict cost given by Treadstone Funding or People Financing. To own a precise, up-to-day offer to the home loan cost, delight talk to a licensed Loan Administrator.

What is actually home financing Interest rate?

A mortgage interest rate is actually a percentage of one’s overall financing harmony. Its reduced monthly, along with your dominating fee, up until the loan is paid down. Its a component inside choosing the fresh annual pricing in order to borrow funds off a lender to order property and other possessions. Eg, Should your rate of interest was 5%, you’ll are obligated to pay the lender 5% of financing harmony from year to year till the financing is paid from.

It rate is generally influenced by several points in the economy and you can financial support hobby, including personal certification. New center factor? Fannie mae and you may Freddie Mac package mortgages, next sell these to dealers. Any sort of interest rate the individuals traders are prepared to pay for home loan-backed ties determines exactly what costs https://paydayloancolorado.net/boone/ loan providers can also be intent on its loans.

What’s the Difference between Rates and Apr?

When looking for property, it’s also possible to discover a couple separate data shown while the a percentage: the borrowed funds rate of interest together with Apr.

Apr signifies annual percentage rate. An annual percentage rate (APR) is a greater way of measuring the price of borrowing from the bank money than simply the speed. The Annual percentage rate reflects the rate, one products, mortgage broker charge, or other charges you spend to find the financing. As a result of this, the Apr can be higher than their interest rate.

How does the speed Apply to My personal Financial within the Western Michigan?

Towards the a 30-seasons repaired-price financial having a loan amount off $160,000 within the Michigan, a good 0.1% improvement in speed influences the payment per month from the about $10-20, predicated on Currency Significantly less than 30.

Remember, time lifetime- maybe not the market industry. Waiting to pick for a reduced rate of interest might cost you so much more, especially just like the interest rates are trending upward. Interest rate really should not be new deciding factor on the Michigan home purchase. Talk to financing Manager and make a-game plan for your residence pick, it doesn’t matter the interest!

How to Get a diminished Rate of interest?

Though financial rates of interest are determined by the sector fashion, there are many steps you can take to reduce your desire rates.

- Reduce your loan name

- Set a larger downpayment

- Improve your credit fitness

- Buy discount things on your financing

Faq’s regarding Rates

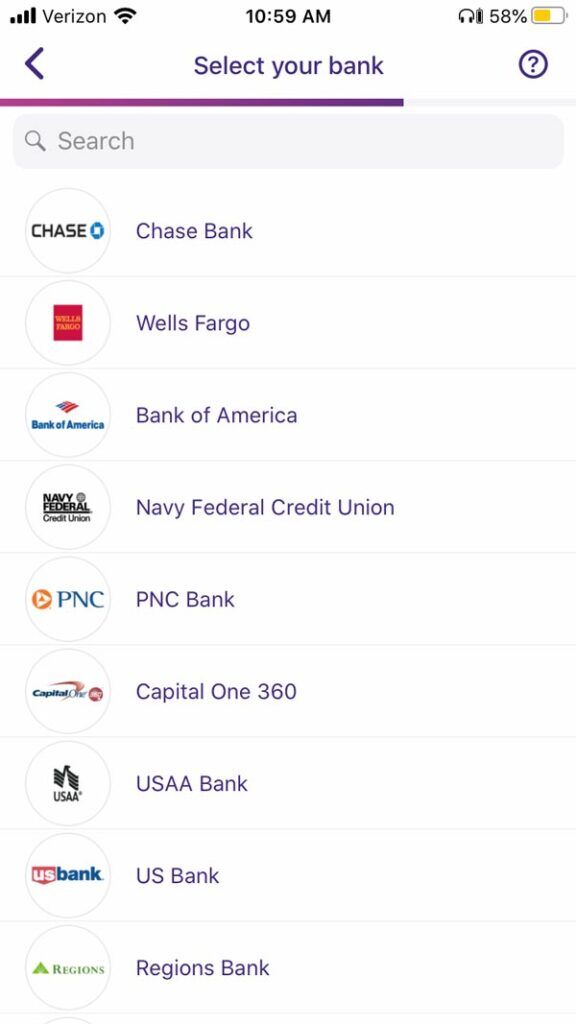

Exactly what are your rates? Just like fuel costs, rates of interest change each day and is according to your unique condition. Please get in touch with a Authorized Loan Officials to obtain a beneficial offer.

How does borrowing connect with our very own rates? Of a lot affairs need to be considered when determining their interest rate, with your credit score becoming only 1 section of that it formula. Overall, increased credit history leads to a lesser interest rate.

What is the difference between my Interest rate and you may Apr? An interest rate was a share of the prominent balance to your your loan billed on the a yearly basis. Attract try paid down month-to-month and you can amortized across the title of the financing. Apr (apr) circumstances in every the costs and you will fees of the financing and you will expresses all of them just like the a share. It is becoming questioned your Apr is higher than the interest rate.

Just what programs were there getting very first-big date homebuyers? Conventional home mortgage investors Federal national mortgage association and you can Freddie Mac computer give basic-big date house client mortgage apps, also known as Homeready and HomePossible, correspondingly. There are money limits and you may credit requirements that needs to be satisfied so you can qualify. Such apps render a great deal more beneficial rates, lower individual home loan insurance, and you will liberty towards amount you could potentially establish.

*Mortgage interest levels, rates, and you can examples was to have instructional intentions just. No commitment to lend suggested. Chat to financing Manager to choose their eligibility.