Sallie Mae Student education loans

I encourage people and you will family members before everything else coupons, has, scholarships, and you may government student loans to cover college or university. College students and you will family is to look at all the expected monthly mortgage repayments, as well as how much the college student needs to earn afterwards, prior to offered a personal student loan.

Give yourself a rest! Register for U regarding I People Credit Union’s Disregard-A-Shell out system and you can forget about your next payment into qualifying credit relationship loan(s)*. Use the more money to capture upon debts and take advantageous asset of high conversion. Have significantly more than one qualifying loan? You can miss out the payments each!

There was a great $ non-refundable handling percentage for each and every financing to participate in the fresh new disregard program. A maximum of a few ignore repayments appear per loan for each season into the existence full to not ever exceed over several a-year of your modern financing title. Payments may possibly not be overlooked in 2 consecutive months. All Charge, Financial, Household Security, one mortgage with a phrase longer than 84 weeks, and you can people financing within the an active percentage arrangement is ineligible to possess ignore money.

To take advantageous asset of an avoid-a-percentage, log on to electronic banking and you may submit brand new Forget about-A-Commission form below Safe Variations.

Although not, if you are searching to possess a personal education loan choice, take a look below

*By the signing above, your authorize UICCU to increase your final financing payment by the you to times. No percentage are needed on your own loan about month skipped; but not, you will be needed to restart the on a regular basis planned commission the latest adopting the times. The $ non-refundable handling commission each mortgage could well be immediately deducted from the membership, except if a check is actually sealed. Desire will continue to accrue on your mortgage inside times your disregard your own percentage. Loan money generated thanks to Payroll Deduction, Direct Put or ACH might be placed to your Bank account into the times youre skipping the percentage. If profile on credit connection are not into the an excellent status, the brand new discount is actually invalid. Any loan that is overdue is not eligible to skip a repayment. The initial complete contractual fee should be put on the borrowed funds before are experienced having a skip payment. If the operating commission isnt added to the program, your request could be refuted plus regular percentage would-be necessary (or applied regarding an automatic commission). A maximum of one or two skip costs appear for every single financing for every single twelve months towards lifestyle overall never to surpass more a few a-year of your fresh loan name. Costs might not be overlooked in 2 successive weeks. UICCU supplies the ability to deny people consult. Multiple skips will get remove possible Gap allege otherwise credit insurance rates benefits. Speak to your vendor to have information. Every Visa, Financial loans Long Barn, Household Collateral, Express Write Solution Loans, Workout Financing, one loan having a phrase longer than 84 days, and you will people financing when you look at the an energetic commission plan try ineligible to own ignore payments. A member having an energetic Collateral Safeguards Insurance coverage (CPI) rules for the a financing would-be ineligible getting skip costs on that mortgage as well as funds where that user are possibly a borrower or cosigner/guarantor.

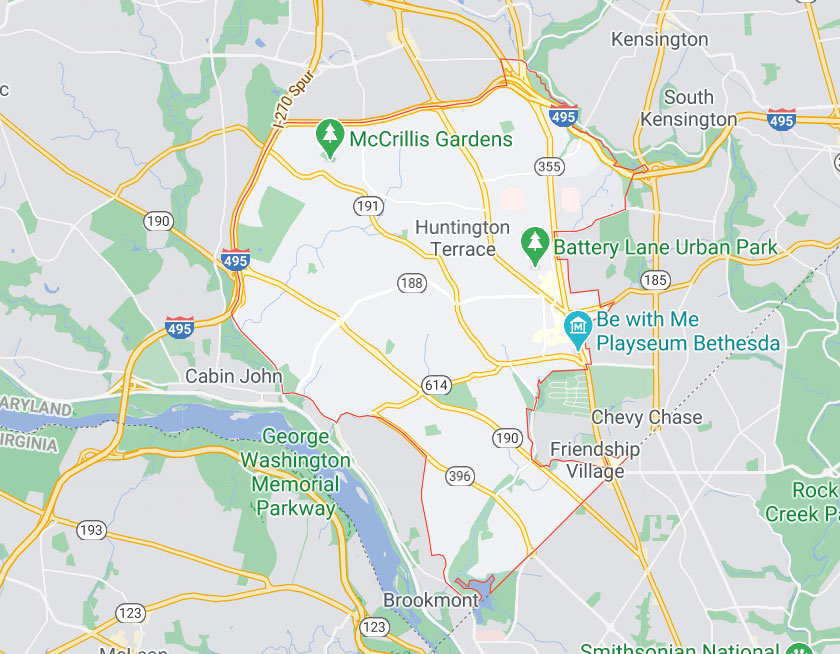

I cannot provide particular pointers (i paid dollars), however, I would personally see loan providers which have a reputation to possess smooth/small deals, whom be aware of the local iliar to your nutty rates right here. Entering contract is tough adequate (especially contending along with-bucks offers), you will not want the deal locate bogged down in case the bank drops the ball or you will find the lowest-ball appraisal.