Great news! Homeownership continues to be you are able to which have poor credit. While you are your credit score is important, loan providers also check your money, deals, bills, expenditures, and you may obligations-to-earnings proportion to own a more complete image of debt balances. Including, there are financial software created specifically to have an initial-go out homebuyer that have bad credit.

Sure, you should buy a home loan with bad credit! Of several loan providers commonly approve mortgages for certified consumers having bad credit. Several lenders even focus on mortgages for homebuyers which have an excellent reasonable credit history. In comparison looking, you can find out perhaps the selection of cost was possible according to your budget.

Regulators financial applications is another option having a primary-time homebuyer with poor credit. Mainly because normally have alot more beneficial terminology, it’s best to find out if you qualify for these first. Let’s look closer.

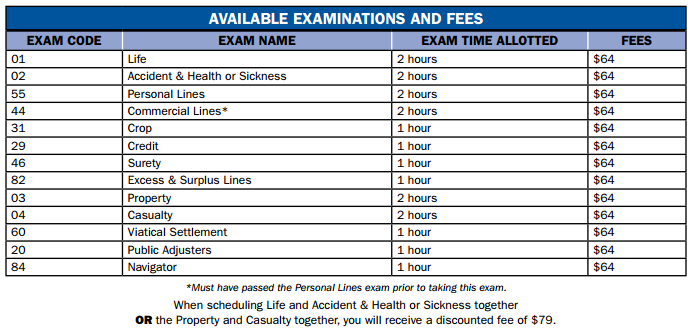

Software for buying a property Which have Bad credit

Government financial apps are produced and work out homeownership easy for a great deal more Us citizens. In the event that U.S. bodies backs the borrowed funds, loan providers accept faster risk, and therefore they might be a great deal more prepared to approve lenders to own bad borrowing from the bank basic-big date people. For every system has different qualification requirements, so be sure to look at the program’s website to know much more about the application form process and how to see a lender that offers these types of mortgage online payday loan Stafford Springs CT loans.

FHA Mortgage

The newest Federal Property Administration (FHA) loan provides the low credit score needs. If you’re able to build an effective ten% down payment, you can purchase an enthusiastic FHA mortgage that have a score anywhere between 500-579. But even although you could only generate a beneficial step three.5% down-payment, your score is 580+. Remember, for those who lay out lower than 10%, you pay financial insurance policies for the whole mortgage label.

Va Loan

As the Veterans Items (VA) loan is only a choice for veterans or productive provider users, its an invaluable benefit. You should buy a home and no deposit otherwise mortgage insurance coverage. However, just like the Va cannot thing the loan, you will need to see an excellent Va-acknowledged lender which accepts your credit score. The common try 620.

USDA Financing

The brand new U.S. Institution of Farming (USDA) money has even more requirements than the others. You prefer the absolute minimum credit history regarding 640, as well as your domestic have to be located in an eligible place. In addition, you need fulfill earnings certification regarding city.

Federal national mortgage association HomeReady

New Federal national mortgage association HomeReady system features a credit history the least 620 and you may create a downpayment as low as 3% of the purchase price. Federal national mortgage association and additionally allows you to cancel the mortgage insurance policies after you are able to 20% equity. However, their total income might not surpass 80% of one’s city median earnings towards home’s venue. A separate work for is that the financial commonly think about the earnings from most other family members (not merely the latest individuals obligated from the financing).

Freddie Mac Family You can

The new Freddie Mac computer Domestic You’ll be able to system demands a credit rating from 660, some more than Federal national mortgage association. It’s also possible to establish simply step 3% and you can terminate your own home loan insurance rates shortly after reaching 20% guarantee. Possesses a comparable money standards. But not, weighed against Federal national mortgage association, what’s more, it also offers a mortgage choice for individuals with zero borrowing from the bank records.

Strategies for First time Homebuyers that have Poor credit

When you find yourself you’ll find pressures having a primary-big date homebuyer with less than perfect credit, below are a few activities to do to get greatest focus prices to make the application while the strong you could.

Show your credit score

If you have numerous loans or skipped payments, you could suppose your credit score is reduced. Yet not, in the event that time has enacted, the problems you’re concerned with may not be impacting your get as much as do you think. You could demand a no cost backup of your credit file of each of around three significant credit agencies once yearly during the AnnualCreditReport.

Right your credit score

Usually do not bring your credit history at par value. Guarantee that it is exact. After you located your credit file, they’ll is information about how to correct any errors.

Pay down the money you owe

This will help to in 2 indicates. Earliest, you can easily change your credit rating (it must be less than 30% of your own full credit limit). Next, your own lender commonly test thoroughly your personal debt-to-money proportion, which compares their monthly premiums along with your revenues. A reduced proportion may help make up for a poor credit score.

Help save a more impressive downpayment

A bigger down-payment form you will be applying for an inferior financing, which is reduced risk on financial. You happen to be and additionally less likely to want to default in case the monthly mortgage repayments aren’t given that higher.

Have shown financial balance

Paying your financial situation and you will saving for a more impressive down-payment are two methods inform you you will be economically secure. But there are many other choices.

- Enhance your earnings (possibly with a brand new employment or front hustle)

- Reveal that their book is much like exactly what your mortgage payments might be

- Show that you’ve started together with your most recent workplace for a long time

- Make your savings set aside

Envision incorporating an excellent co-signer

Having a great co-signer, you might be inside a far greater standing to possess financing approval. Although not, feel obvious on which it means late otherwise skipped payments may also harm their co-signer’s borrowing from the bank. Do you take on so it obligation?

Talk to good HUD-recognized casing counselor

The fresh new U.S. Institution of Casing and you may Metropolitan Development (HUD) sponsors homes counseling providers from the country which can provide good advice to the to buy a house and you will borrowing things. These are typically always the fresh new homebuyer apps explained more than and certainly will let you replace your credit.

Research rates to own home loan cost

Examine rates and you may terms and conditions out-of various other loan providers. This is certainly especially important in the event your borrowing from the bank causes it to be tough to pick an interest rate which have affordable conditions. You could potentially examine money away from different types of loan providers, instance home loan enterprises, national and you may people banking institutions, and you may borrowing unions.

So, let’s accept issue: Can i buy a property that have bad credit? The solution try yes, nonetheless it takes time and you can lookup to check on all home loan alternatives for a knowledgeable monetary choice. You reside within reach!